Sears 2014 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

115

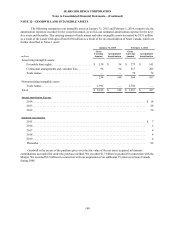

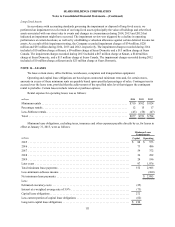

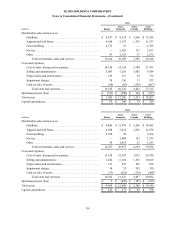

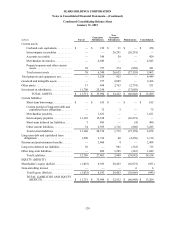

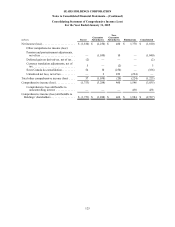

NOTE 17—SUMMARY OF SEGMENT DATA

These reportable segment classifications are based on our business formats, as described in Note 1. The Kmart

and Sears Canada formats each represent both an operating and reportable segment. As a result of the de-

consolidation of Sears Canada as described in Note 2, Sears Canada is no longer an operating or reportable segment,

and the segment results presented below reflect the operating results for Sears Canada through October 16, 2014.

The Sears Domestic reportable segment consists of the aggregation of several business formats. These formats are

evaluated by our Chief Operating Decision Maker ("CODM") to make decisions about resource allocation and to

assess performance.

Each of these segments derives its revenues from the sale of merchandise and related services to customers,

primarily in the United States and Canada. The merchandise and service categories are as follows:

(i) Hardlines—consists of home appliances, consumer electronics, lawn & garden, tools & hardware,

automotive parts, household goods, toys, housewares and sporting goods;

(ii) Apparel and Soft Home—includes women's, men's, kids', footwear, jewelry, accessories and soft home;

(iii) Food and Drug—consists of grocery & household, pharmacy and drugstore;

(iv) Service—includes repair, installation and automotive service and extended contract revenue; and

(v) Other—includes revenues earned in connection with our agreements with SHO and Lands' End, as well as

credit revenues and licensed business revenues.

2014

millions Kmart Sears

Domestic Sears

Canada Sears

Holdings

Merchandise sales and services:

Hardlines. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,605 $ 8,903 $ 1,100 $ 13,608

Apparel and Soft Home . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,049 3,673 880 8,602

Food and Drug . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,326 12 — 4,338

Service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 2,318 77 2,412

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77 2,130 31 2,238

Total merchandise sales and services . . . . . . . . . . . . . . . . . 12,074 17,036 2,088 31,198

Costs and expenses:

Cost of sales, buying and occupancy . . . . . . . . . . . . . . . . . . . . . 9,513 12,950 1,586 24,049

Selling and administrative . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,962 4,655 603 8,220

Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . 95 437 49 581

Impairment charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29 19 15 63

(Gain) loss on sales of assets . . . . . . . . . . . . . . . . . . . . . . . . . . . (103)(105) 1 (207)

Total costs and expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . 12,496 17,956 2,254 32,706

Operating loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(422) $ (920) $ (166) $ (1,508)

Total assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,155 $ 10,054 $ — $ 13,209

Capital expenditures. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 45 $ 193 $ 32 $ 270