Sears 2014 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

112

NOTE 15—RELATED PARTY DISCLOSURE

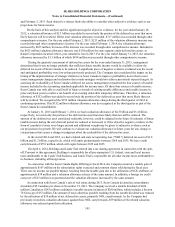

Investment of Surplus Cash

Our Board has delegated authority to direct investment of our surplus cash to Mr. Lampert, subject to various

limitations that have been or may be from time to time adopted by the Board of Directors and/or the Finance

Committee of the Board of Directors. Mr. Lampert is Chairman of our Board of Directors and its Finance

Committee and is the Chairman and Chief Executive Officer of ESL. Additionally, on February 1, 2013, Mr.

Lampert became our Chief Executive Officer, in addition to his role as Chairman of the Board. Neither Mr. Lampert

nor ESL will receive compensation for any such investment activities undertaken on our behalf, other than Mr.

Lampert's compensation as our Chief Executive Officer. ESL owned approximately 49% of our outstanding

common stock at January 31, 2015.

Further, to clarify the expectations that the Board of Directors has with respect to the investment of our surplus

cash, the Board has renounced, in accordance with Delaware law, any interest or expectancy of the Company

associated with any investment opportunities in securities that may come to the attention of Mr. Lampert or any

employee, officer, director or advisor to ESL and its affiliated investment entities (each, a "Covered Party") who also

serves as an officer or director of the Company other than (a) investment opportunities that come to such Covered

Party’s attention directly and exclusively in such Covered Party’s capacity as a director, officer or employee of the

Company, (b) control investments in companies in the mass merchandising, retailing, commercial appliance

distribution, product protection agreements, residential and commercial product installation and repair services and

automotive repair and maintenance industries and (c) investment opportunities in companies or assets with a

significant role in our retailing business, including investment in real estate currently leased by the Company or in

suppliers for which the Company is a substantial customer representing over 10% of such companies’ revenues, but

excluding investments of ESL that were existing as of May 23, 2005.

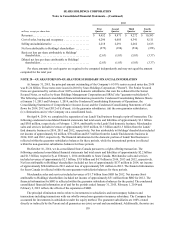

Unsecured Commercial Paper

During 2014 and 2013, ESL and its affiliates held unsecured commercial paper issued by SRAC, an indirect

wholly owned subsidiary of Holdings. For the commercial paper outstanding to ESL, the weighted average of each

of maturity, annual interest rate, and principal amount outstanding for this commercial paper was 18.8 days, 3.68%

and $27.7 million and 28.9 days, 2.76% and $184 million, respectively, in 2014 and 2013. The largest aggregate

amount of principal outstanding to ESL at any time since the beginning of 2014 was $150 million and the aggregate

amount of interest paid by SRAC to ESL during 2014 was $1 million. ESL held none of our commercial paper at

January 31, 2015 or February 1, 2014, including any held by Mr. Lampert. The commercial paper purchases were

made in the ordinary course of business on substantially the same terms, including interest rates, as terms prevailing

for comparable transactions with other persons, and did not present features unfavorable to the Company.

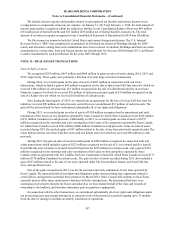

Secured Short-Term Loan

In September 2014, the Company, through Sears, Sears Development Co., and Kmart Corporation

("Borrowers"), entities wholly-owned and controlled, directly or indirectly by the Company, entered into a $400

million secured short-term loan (the "Loan") with JPP II, LLC and JPP, LLC (together, the "Lender"), entities

affiliated with ESL. The Loan was originally scheduled to mature on December 31, 2014. As permitted by the Loan

agreement, the Company paid an extension fee equal to 0.5% of the principal amount to extend the maturity date of

the loan to February 28, 2015. The Loan has an annual base interest rate of 5%. The Loan is guaranteed by the

Company and is secured by a first priority lien on certain real properties owned by the Borrowers. The Lender sold

certain participating interests in the Loan during the third quarter, which may restrict the Lender’s ability to take

certain actions with respect to the Loan without consent of the purchasers of such participating interests, including

the waiver of certain defaults under the Loan.

At January 31, 2015, the outstanding balance of the Loan was $400 million. During 2014, the Borrowers paid

an upfront fee of $7 million, an extension fee of $2 million and interest of $5.6 million to the Lender. On February

25, 2015, we entered into an agreement effective February 28, 2015, to amend and extend the $400 million secured

short-term loan. Under the terms of the amendment, we repaid $200 million of the $400 million on March 2, 2015

and, in connection with this repayment, the Lender agreed to release at the Company's option, one half of the value