Sears 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.51

Senior Unsecured Notes

On October 20, 2014, the Company announced its board of directors had approved a rights offering allowing

its stockholders to purchase up to $625 million in aggregate principal amount of 8% senior unsecured notes due

2019 and warrants to purchase shares of its common stock. The subscription rights were distributed to all

stockholders of the Company as of October 30, 2014, the record date for this rights offering, and every stockholder

had the right to participate on the same terms in accordance with its pro rata ownership of the Company's common

stock, except that holders of the Company's restricted stock that was unvested as of the record date received cash

awards in lieu of subscription rights. This rights offering closed on November 18, 2014 and was oversubscribed.

Accordingly, on November 21, 2014, the Company issued $625 million aggregate original principal amount of

8% senior unsecured notes due 2019 (the "Senior Unsecured Notes") and received proceeds of $625 million which

were used for general corporate purposes. The Senior Unsecured Notes are the unsecured and unsubordinated

obligations of the Company and rank equal in right of payment with the existing and future unsecured and

unsubordinated indebtedness of the Company. The Senior Unsecured Notes bear interest at a rate of 8% per annum

and the Company will pay interest semi-annually on June 15 and December 15 of each year. The Senior Unsecured

Notes are not guaranteed.

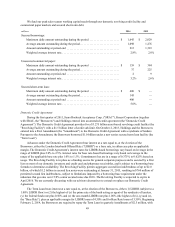

We accounted for the Senior Unsecured Notes in accordance with accounting standards applicable to

distinguishing liabilities from equity and debt with conversion and other options. Accordingly, we allocated the

proceeds received for the Senior Unsecured Notes based on the relative fair values of the Senior Unsecured Notes

and warrants, which resulted in a discount to the notes of approximately $278 million. The fair value of the Senior

Unsecured Notes and warrants was estimated based on quoted market prices for the same issues using Level 1

measurements as defined in Note 5. The discount is being amortized over the life of the Senior Unsecured Notes

using the effective interest method with an effective interest rate of 11.55%. Approximately $5 million of the

discount was amortized during 2014, resulting in a remaining discount of approximately $273 million at January 31,

2015. The book value of the Senior Unsecured Notes net of the remaining discount was approximately $352 million

at January 31, 2015.

Debt Repurchase Authorization

In 2005, our Finance Committee of the Board of Directors authorized the repurchase, subject to market

conditions and other factors, of up to $500 million of our outstanding indebtedness in open market or privately

negotiated transactions. Our wholly owned finance subsidiary, SRAC, has repurchased $215 million of its

outstanding notes. In 2011, Sears Holdings repurchased $10 million of Senior Secured Notes, recognizing a gain of

$2 million. The unused balance of this authorization is $275 million.

Unsecured Commercial Paper

We borrow through the commercial paper markets. At January 31, 2015 and February 1, 2014, we had

outstanding commercial paper borrowings of $2 million and $9 million, respectively. ESL held none of our

commercial paper at January 31, 2015 or February 1, 2014, including any held by Edward S. Lampert. See Note 15

of Notes to Consolidated Financial Statements for further discussion of these borrowings.

Secured Short-Term Loan

On September 15, 2014, the Company, through Sears, Sears Development Co. and Kmart Corporation

("Borrowers"), entities wholly-owned and controlled, directly or indirectly by the Company, entered into a $400

million secured short-term loan (the "Loan'") with JPP II, LLC and JPP, LLC (together, the "Lender"), entities

affiliated with ESL. The first $200 million of the Loan was funded at the closing on September 15, 2014 and the

remaining $200 million was funded on September 30, 2014. Proceeds of the Loan were used for general corporate

purposes.

The Loan was originally scheduled to mature on December 31, 2014. As permitted by the Loan agreement, the

Company paid an extension fee equal to 0.5% of the principal amount to extend the maturity date to February 28,

2015. The Loan has an annual base interest rate of 5%. The Borrowers paid an upfront fee of 1.75% of the full

principal amount.