Sears 2014 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

109

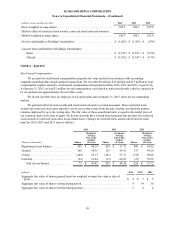

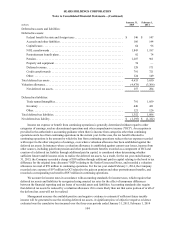

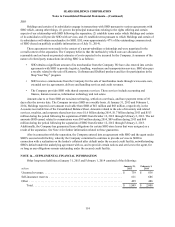

Changes in the carrying amount of goodwill by segment during 2013 and 2014 were as follows:

millions Sears

Domestic

Balance, February 2, 2013 and February 1, 2014:

Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 379

2014 activity:

Separation of Lands' End . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (110)

Balance, January 31, 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 269

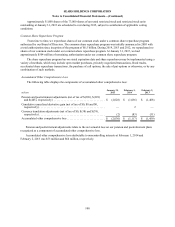

In accordance with accounting standards for goodwill and other intangible assets, goodwill is not amortized

but requires testing for potential impairment, at a minimum on an annual basis, or when indications of potential

impairment exist. The impairment test for goodwill utilizes a fair value approach. The impairment test for

identifiable intangible assets not subject to amortization is also performed annually or when impairment indications

exist, and consist of a comparison of the fair value of the intangible asset with its carrying amount. Identifiable

intangible assets that are subject to amortization are evaluated for impairment using a process similar to that used to

evaluate other long-lived assets.

We perform our annual goodwill and intangible impairment test required under accounting standards at the last

day of our November accounting period each year, or when an indication of potential impairment exists. The

goodwill impairment test involves a two-step process as described in the "Summary of Significant Accounting

Policies" in Note 1. The first step is a comparison of the reporting unit's fair value to its carrying value. If the

carrying value of the reporting unit is higher than its fair value, there is an indication that impairment may exist and

the second step must be performed to measure the amount of impairment loss.

After performing the first step of the process, we determined goodwill recorded at the reporting unit within the

Sears Canada segment in 2012 was potentially impaired. The impairment charge was primarily driven by the

combination of lower sales and continued margin pressure coupled with expense increases which led to a decline in

our operating profit. After performing the second step of the process, we determined that the total amount of

goodwill recorded at this reporting unit was impaired and recorded a charge of $295 million in 2012.

A significant amount of judgment is involved in determining if an indicator of impairment has occurred at a

date other than the annual impairment test date. Such indicators may include, among others: a significant decline in

our stock price and market capitalization; a significant adverse change in legal factors or in the business climate;

unanticipated competition; the testing for recoverability of a significant asset group within the reporting unit; and

slower growth rates.

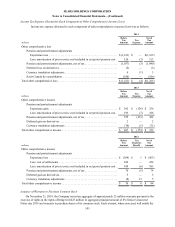

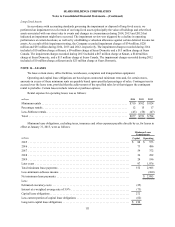

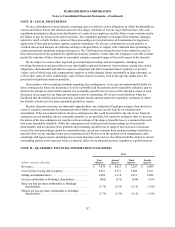

NOTE 13—STORE CLOSING CHARGES, SEVERANCE COSTS AND IMPAIRMENTS

Store Closings and Severance

We closed 173, 70 and 92 stores in our Kmart segment and 61, 23 and 147 stores in our Sears Domestic

segment we previously announced would close, during 2014, 2013 and 2012, respectively. We made the decision to

close 118, 113 and 48 stores in our Kmart segment and 47, 32 and 12 stores in our Sears Domestic segment during

2014, 2013 and 2012, respectively. We also made the decision to close 6 domestic supply chain distribution centers

in our Kmart segment and 1 domestic supply chain distribution center in our Sears Domestic segment during 2014.

In accordance with accounting standards governing costs associated with exit or disposal activities, expenses

related to future rent payments for which we no longer intend to receive any economic benefit are accrued for when

we cease to use the leased space and have been reduced for any income that we believe can be realized through sub-

leasing the leased space. We recorded charges for the related lease obligations of $42 million, $16 million and $34

million at Kmart during 2014, 2013 and 2012, respectively, and of $21 million and $34 million at Sears Domestic

during 2014 and 2012, respectively.

We expect to record additional charges of approximately $30 million during 2015 related to stores and

domestic supply chain distribution centers we had previously made the decision to close.