Sears 2014 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.23

and member touchpoints. We believe these platforms have the potential to scale across our member base and we will

continue to further enhance our products and services to create a more engaging platform on which to deliver value

to our members.

As we enter fiscal 2015, there are three critical areas that we are focusing on in our transformation:

• Restoring profitability to our Company

• Focusing on the Future: Our Best Members, Our Best Stores and Our Best Categories

• Enhancing our Financial Flexibility

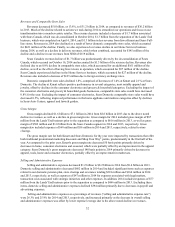

Restoring Profitability To Our Company

We are primarily focusing on profitability instead of revenues, market share and other metrics which relate to,

but do not necessarily drive profit. This means we will be making material changes in some of the underlying

business models that have been challenged for many years, such as Consumer Electronics, where we have

experienced significant losses since 2010. We intend to continue to operate in most of these businesses, but with a

very different approach to serving our members than in the past. This change in approach may negatively impact our

sales; however, it should also reduce the risk of material profit declines. We believe that our focus on profitability

will contribute to a meaningful improvement in performance in 2015 and beyond and we are seeing early signs of

this progress as part of our most recent quarterly results.

Focusing on the Future: Our Best Members, Our Best Stores and Our Best Categories

We have a very substantial member base with more than 70% of sales being derived from Shop Your Way®

members. We are applying our resources towards better understanding the wants and needs of Our Best Members

so that we can apply these learnings towards increasing engagement and strengthening our relationships with all of

our existing members. We believe that by building these relationships there is significant opportunity for growth

through member retention.

As we shift from a Traditional Store Network Model to our Member-Centric Integrated Retail Model, we will

focus on Our Best Stores and will continue to optimize the productivity of our space as we right-size, redeploy and

highlight the value of our assets, including our substantial real estate portfolio.

Finally, we are the market leader in several of the key categories in which we do business, such as Home

Appliances, Home Services and Fitness Equipment and we continue to invest in Our Best Categories to further

reinforce that leadership position.

Enhancing Our Financial Flexibility

We remain focused on ensuring that we will continue to have the financial flexibility to meet all of our

obligations while funding our transformation. In fiscal 2014, we raised approximately $2.3 billion from a variety of

asset reconfiguration and financing activities, including the separation of Lands' End, the sale of a significant portion

of our stake in Sears Canada and the issuance of Senior Unsecured Notes in November.

We are continuing our efforts to develop Sears Holdings as a membership company, without the significant

asset intensity of its traditional retail business. To this end, we announced in November 2014 that we have been

exploring the formation of a Real Estate Investment Trust ("REIT") to purchase some of our properties and to

manage them like a pure real estate company. While we can offer no assurances that such a transaction will be

consummated, we have made progress and are proceeding towards its formation and separation, which is projected

to occur in May or June of this year. We are currently targeting between 200 and 300 Sears and Kmart stores to be

sold to the REIT with expected proceeds to Sears Holdings in excess of $2.0 billion.

We anticipate that the REIT would enable us to continue and to accelerate many of the activities that we have

been pursuing over the past several years. Specifically, we have been working to partner with other retailers and

mall owners to enable us to reduce the operating footprint of our stores to smaller, but still significant spaces, while

leasing part of the store to retailers who will bring increased foot traffic and relevance to our locations.