Sears 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

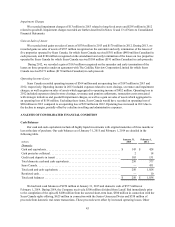

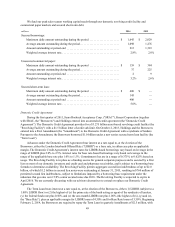

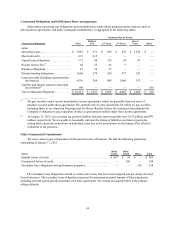

We fund our peak sales season working capital needs through our domestic revolving credit facility and

commercial paper markets and secured short-term debt.

millions 2014 2013

Secured borrowings:

Maximum daily amount outstanding during the period . . . . . . . . . . . . . . . . . . . . . $ 1,645 $ 2,029

Average amount outstanding during the period. . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,098 1,276

Amount outstanding at period-end . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 213 1,323

Weighted average interest rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.8% 2.8%

Unsecured commercial paper:

Maximum daily amount outstanding during the period . . . . . . . . . . . . . . . . . . . . . $ 159 $ 384

Average amount outstanding during the period. . . . . . . . . . . . . . . . . . . . . . . . . . . . 37 225

Amount outstanding at period-end . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 9

Weighted average interest rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.2% 2.6%

Secured short-term loan:

Maximum daily amount outstanding during the period . . . . . . . . . . . . . . . . . . . . . $ 400 $ —

Average amount outstanding during the period. . . . . . . . . . . . . . . . . . . . . . . . . . . . 145 —

Amount outstanding at period-end . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 400 —

Weighted average interest rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.0% —

Domestic Credit Agreement

During the first quarter of 2011, Sears Roebuck Acceptance Corp. ("SRAC"), Kmart Corporation (together

with SRAC, the "Borrowers") and Holdings entered into an amended credit agreement (the "Domestic Credit

Agreement"). The Domestic Credit Agreement provides for a $3.275 billion asset-based revolving credit facility (the

"Revolving Facility") with a $1.5 billion letter of credit sub-limit. On October 2, 2013, Holdings and the Borrowers

entered into a First Amendment (the "Amendment") to the Domestic Credit Agreement with a syndicate of lenders.

Pursuant to the Amendment, the Borrowers borrowed $1.0 billion under a new senior secured term loan facility (the

"Term Loan").

Advances under the Domestic Credit Agreement bear interest at a rate equal to, at the election of the

Borrowers, either the London Interbank Offered Rate ("LIBOR") or a base rate, in either case plus an applicable

margin. The Domestic Credit Agreement’s interest rates for LIBOR-based borrowings vary based on leverage in the

range of LIBOR plus 2.0% to 2.5%. Interest rates for base rate-based borrowings vary based on leverage in the

range of the applicable base rate plus 1.0% to 1.5%. Commitment fees are in a range of 0.375% to 0.625% based on

usage. The Revolving Facility is in place as a funding source for general corporate purposes and is secured by a first

lien on most of our domestic inventory and credit card and pharmacy receivables, and is subject to a borrowing base

formula to determine availability. The Revolving Facility permits aggregate second lien indebtedness of up to $2.0

billion, of which $1.2 billion in second lien notes were outstanding at January 31, 2015, resulting in $760 million of

permitted second lien indebtedness, subject to limitations imposed by a borrowing base requirement under the

indenture that governs our 6 5/8% senior secured notes due 2018. The Revolving Facility is expected to expire in

April 2016. We are currently discussing with our advisors alternatives to extend or replace our Domestic Credit

Agreement.

The Term Loan bears interest at a rate equal to, at the election of the Borrowers, either (1) LIBOR (subject to a

1.00% LIBOR floor) or (2) the highest of (x) the prime rate of the bank acting as agent of the syndicate of lenders,

(y) the federal funds rate plus 0.50% and (z) the one-month LIBOR rate plus 1.00% (the highest of (x), (y) and (z),

the "Base Rate"), plus an applicable margin for LIBOR loans of 4.50% and for Base Rate loans of 3.50%. Beginning

February 2, 2014, the Borrowers are required to repay the Term Loan in quarterly installments of $2.5 million, with