Sears 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

The Loan is guaranteed by the Company and is secured by a first priority lien on certain real properties owned

by the Borrowers. In certain circumstances, the Lender may exercise its reasonable determination to substitute one

or more of the properties with substitute properties. The Loan includes customary representations and covenants,

including with respect to the condition and maintenance of the real property collateral.

The Loan has customary events of default, including (subject to certain materiality thresholds and grace

periods) payment default, failure to comply with covenants, material inaccuracy of representation or warranty, and

bankruptcy or insolvency proceedings. If there is an event of default, the Lender may declare all or any portion of

the outstanding indebtedness to be immediately due and payable, exercise any rights it might have under any of the

Loan documents (including against the collateral), and instead of the base interest rate, the Borrowers will be

required to pay a default rate equal to the greater of (i) 2.5% in excess of the base interest rate and (ii) the prime rate

plus 1%. The Loan may be prepaid in whole or in part any time prior to maturity, without penalty or premium.

The Lender sold certain participating interests in the Loan during the third quarter, which may restrict the

Lender’s ability to take certain actions with respect to the Loan without consent of the purchasers of such

participating interests, including the waiver of certain defaults under the Loan.

At January 31, 2015, the outstanding balance of the Loan was $400 million. On February 25, 2015, we entered

into an agreement effective February 28, 2015, to amend and extend the $400 million secured short-term loan.

Under the terms of the amendment, we repaid $200 million of the $400 million on March 2, 2015 and, in connection

with this repayment, the Lender agreed to release at the Company's option, one half of the value of the pledged

collateral. The maturity date of the Loan was extended until the earlier of June 1, 2015, or the receipt by the

Company of the sale proceeds pursuant to the potential REIT transaction. At any time prior to maturity of the Loan,

Borrowers may make a one-time election to re-borrow up to $200 million from the Lender (the "Delayed Advance"),

subject to certain conditions, including payment to the Lender of a fee equal to 0.25% of the principal amount of the

Delayed Advance. In the event the Company elects to re-borrow the Delayed Advance, Borrowers would again grant

a lien on the released properties to secure the Loan.

Debt Ratings

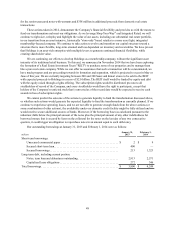

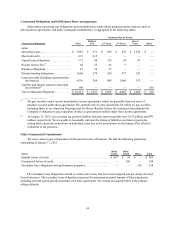

Our corporate family debt ratings at January 31, 2015 appear in the table below:

Moody’s

Investors Service Standard & Poor’s

Ratings Services Fitch Ratings

Caa1 CCC+ CC

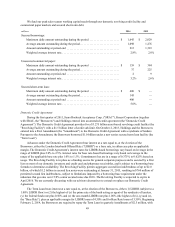

Domestic Pension Plan Funding

Contributions to our pension plans remain a significant use of our cash on an annual basis. While the

Company's pension plan is frozen, and thus associates do not currently earn pension benefits, the Company has a

legacy pension obligation for past service performed by Kmart and Sears associates. During 2014, we contributed

$418 million to our domestic pension plans. We estimate that the domestic pension contribution will be $279 million

in 2015 and approximately $286 million in 2016, though the ultimate amount of pension contributions could be

affected by changes in the applicable regulations, as well as financial market and investment performance.

In 2012, federal legislation was signed into law which allowed pension plan sponsors to use higher interest rate

assumptions in valuing plan liabilities and determining funding obligations. As a result of this legislation, the

Company's domestic pension plan was within $203 million of being 80% funded under applicable law. In order to

reduce the risks of gross pension obligations, the Company elected to contribute an additional $203 million to its

domestic pension plan on September 14, 2012, after which its domestic pension plan was 80% funded under

applicable law.

Effective September 17, 2012, the Company amended its domestic pension plan, primarily related to lump sum

benefit eligibility, and began notifying certain former employees of the Company of its offer to pay those employees'

pension benefit in a lump sum. These amendments did not have a significant impact on our plan. Former employees

eligible for the voluntary lump sum payment option are generally those who are vested traditional formula