Sears 2014 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2014 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

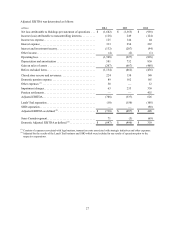

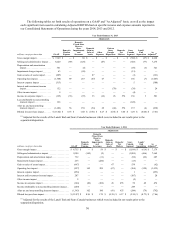

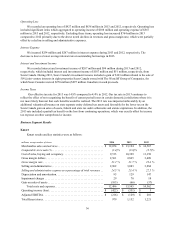

The components of the adjustments to EBITDA related to domestic pension expense were as follows:

millions 2014 2013 2012

Components of net periodic expense:

Interest cost. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 221 $ 219 $ 291

Expected return on plan assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . (247)(224)(291)

Amortization of experience losses . . . . . . . . . . . . . . . . . . . . . . . . . 115 167 165

Net periodic expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 89 $ 162 $ 165

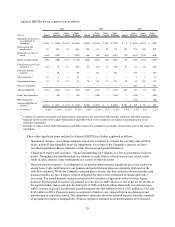

In accordance with GAAP, we recognize on the balance sheet actuarial gains and losses for defined

benefit pension plans annually in the fourth quarter of each fiscal year and whenever a plan is determined

to qualify for a remeasurement during a fiscal year. For income statement purposes, these actuarial gains

and losses are recognized throughout the year through an amortization process. The Company recognizes in

its results of operations, as a corridor adjustment, any unrecognized actuarial net gains or losses that exceed

10% of the larger of projected benefit obligations or plan assets. Accumulated gains/losses that are inside

the 10% corridor are not recognized, while accumulated actuarial gains/losses that are outside the 10%

corridor are amortized over the "average future service" of the population and are included in the

amortization of experience losses line item above.

Actuarial gains and losses occur when actual experience differs from the estimates used to allocate

the change in value of pension plans to expense throughout the year or when assumptions change, as they

may each year. Significant factors that can contribute to the recognition of actuarial gains and losses

include changes in discount rates used to remeasure pension obligations on an annual basis or upon a

qualifying remeasurement, differences between actual and expected returns on plan assets and other

changes in actuarial assumptions. Management believes these actuarial gains and losses are primarily

financing activities that are more reflective of changes in current conditions in global financial markets

(and in particular interest rates) that are not directly related to the underlying business and that do not have

an immediate, corresponding impact on the benefits provided to eligible retirees. For further information on

the actuarial assumptions and plan assets referenced above, see Management's Discussion and Analysis of

Financial Condition and Results of Operations - Application of Critical Accounting Policies and Estimates -

Defined Benefit Pension Plans, and Note 7 of Notes to Consolidated Financial Statements.

• Pension settlements – In 2012, the Company amended its domestic pension plan and offered a one-time

voluntary lump sum payment option in an effort to reduce its long-term pension obligations and ongoing

annual pension expense. The pension settlements were funded from existing pension plan assets. In connection

with this transaction, the Company incurred a charge to operations as a result of the requirement to expense

the unrealized actuarial losses. The charge had no effect on equity because the unrealized actuarial losses are

already recognized in accumulated other comprehensive income/(loss). Accordingly, the effect on retained

earnings was offset by a corresponding reduction in accumulated other comprehensive loss.

• Lands' End separation – The results of the Lands' End business that were included in our results of operations

prior to the separation.

• SHO separation – The results of the Sears Hometown and Outlet businesses that were included in our results

of operations prior to the separation.