Sears 2013 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

91

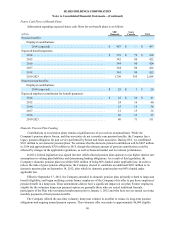

terminated vested participants, representing approximately $2.0 billion of the Company's total qualified pension plan

liabilities. Eligible participants had until November 19, 2012 to make their election. The Company made payments

of approximately $1.5 billion to employees who made the election in December 2012 and funded the payments from

existing pension plan assets. In connection with this transaction, the Company incurred a non-cash charge to

operations of approximately $452 million pre-tax in the fourth quarter of 2012 as a result of the requirement to

expense the unrealized actuarial losses. The charge had no effect on equity because the unrealized actuarial losses

are already recognized in accumulated other comprehensive income/(loss). Accordingly, the effect on retained

earnings was offset by a corresponding reduction in accumulated other comprehensive loss.

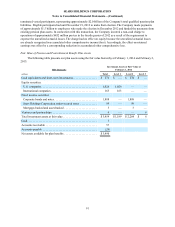

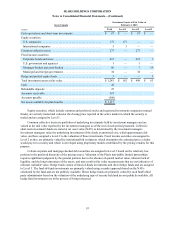

Fair Value of Pension and Postretirement Benefit Plan Assets

The following table presents our plan assets using the fair value hierarchy at February 1, 2014 and February 2,

2013:

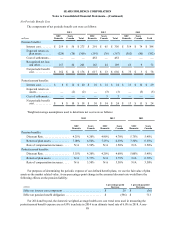

Investment Assets at Fair Value at

SHC Domestic February 1, 2014

millions Total Level 1 Level 2 Level 3

Cash equivalents and short-term investments. . . . . . . . . . . . . . . . . $ 274 $ — $ 274 $ —

Equity securities:

U.S. companies. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,026 1,026 — —

International companies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 163 163 — —

Fixed income securities:

Corporate bonds and notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,888 — 1,888 —

Sears Holdings Corporation senior secured notes . . . . . . . . . . . . 99 — 99 —

Mortgage-backed and asset-backed . . . . . . . . . . . . . . . . . . . . . . . 3 — 3 —

Ventures and partnerships. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 — — 6

Total investment assets at fair value . . . . . . . . . . . . . . . . . . . . . . . . $ 3,459 $1,189 $ 2,264 $ 6

Cash. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Accounts receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57

Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (29)

Net assets available for plan benefits . . . . . . . . . . . . . . . . . . . . . . . $ 3,490