Sears 2013 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

• Second, the management of these separated businesses are better able to pursue their own strategic

opportunities, optimize their capital structures, attract talent, and allocate capital in a more focused manner;

• Third, they provide multiple opportunities for our shareholders to participate in the value creation generated

by these businesses; and

• Finally, they potentially enhance Sears Holdings’ and the separated entities’ financial flexibility.

We believe that we can readily generate liquidity from our asset base. In fact, in 2013 we generated $2.0

billion of liquidity consisting of $1.0 billion through real estate transactions in the United States and Canada and

another $1.0 billion, as we executed a five-year secured term loan in October 2013. We expect to continue with these

types of activities during 2014. We currently anticipate generating about $500 million from an exit dividend in

connection with the previously announced separation of Lands' End through a pro rata distribution to our

shareholders, with the separation being subject to certain conditions. We currently expect that the combination of (1)

the Lands' End transaction, (2) our continuing to work with the board and management of Sears Canada to increase

the value of our investment, which has a market value as of March 14, 2014 of about $760 million, and realize

significant cash proceeds and (3) our evaluation of opportunities with respect to a potential separation of our Sears

Auto Centers when taken together will result in cash proceeds to the Company in excess of $1.0 billion in 2014,

which will help fund our transformation and create value.

RESULTS OF OPERATIONS

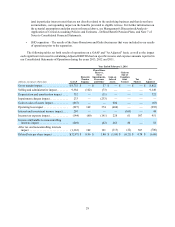

Fiscal Year

Our fiscal year end is the Saturday closest to January 31 each year. Fiscal years 2013 and 2011 consisted of 52

weeks while fiscal year 2012 consisted of 53 weeks. Unless otherwise stated, references to years in this report relate

to fiscal years rather than to calendar years. The following fiscal periods are presented in this report.

Fiscal year Ended Weeks

2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . February 1, 2014 52

2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . February 2, 2013 53

2011 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . January 28, 2012 52