Sears 2013 Annual Report Download - page 70

Download and view the complete annual report

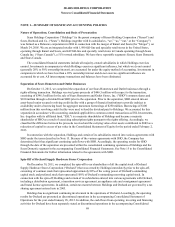

Please find page 70 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

70

Merchandise Inventories

Merchandise inventories are valued at the lower of cost or market. For Kmart and Sears Domestic, cost is

primarily determined using the retail inventory method (“RIM”). Kmart merchandise inventories are valued under

the RIM using primarily a first-in, first-out (“FIFO”) cost flow assumption. Sears Domestic merchandise inventories

are valued under the RIM using primarily a last-in, first-out (“LIFO”) cost flow assumption. For Sears Canada, cost

is determined using the average cost method based on individual items.

Inherent in the RIM calculation are certain significant management judgments and estimates including, among

others, merchandise markons, markups, markdowns and shrinkage, which significantly impact the ending inventory

valuation at cost, as well as resulting gross margins. The methodologies utilized by us in our application of the RIM

are consistent for all periods presented. Such methodologies include the development of the cost-to-retail ratios, the

groupings of homogenous classes of merchandise, the development of shrinkage and obsolescence reserves, the

accounting for price changes and the computations inherent in the LIFO adjustment (where applicable).

Management believes that the RIM provides an inventory valuation that reasonably approximates cost and results in

carrying inventory at the lower of cost or market.

Approximately 47% of consolidated merchandise inventories are valued using LIFO. To estimate the effects of

inflation on inventories, we utilize external price indices determined by an outside source, the Bureau of Labor

Statistics. If the FIFO method of inventory valuation had been used instead of the LIFO method, merchandise

inventories would have been $70 million higher at February 1, 2014 and $72 million higher at February 2, 2013.

Vendor Rebates and Allowances

We receive rebates and allowances from certain vendors through a variety of programs and arrangements

intended to offset our costs of promoting and selling certain vendor products. These vendor payments are recognized

and recorded as a reduction to the cost of merchandise inventories when earned and, thereafter, as a reduction of cost

of sales, buying and occupancy as the merchandise is sold. Upfront consideration received from vendors linked to

purchases or other commitments is initially deferred and amortized ratably to cost of sales, buying and occupancy

over the life of the contract or as performance of the activities specified by the vendor to earn the fee is completed.

Property and Equipment

Property and equipment are recorded at cost, less accumulated depreciation. Additions and substantial

improvements are capitalized and include expenditures that materially extend the useful lives of existing facilities

and equipment. Maintenance and repairs that do not materially improve or extend the lives of the respective assets

are expensed as incurred.

Depreciation expense, which includes depreciation on assets under capital leases, is recorded over the

estimated useful lives of the respective assets using the straight-line method for financial statement purposes, and

accelerated methods for tax purposes. The range of lives are generally 20 to 50 years for buildings, 3 to 10 years for

furniture, fixtures and equipment, and 3 to 5 years for computer systems and computer equipment. Leasehold

improvements are depreciated over the shorter of the associated lease term or the estimated useful life of the asset.

Depreciation expense included within depreciation and amortization expense reported on the Consolidated

Statements of Operations was $703 million, $778 million, and $798 million for the years ended February 1, 2014,

February 2, 2013 and January 28, 2012, respectively.

Primarily as a result of store closing actions, certain property and equipment are considered held for sale. The

value of assets held for sale was $39 million and $57 million at February 1, 2014 and February 2, 2013, respectively.

These assets were included in prepaid expenses and other current assets in the Consolidated Balance Sheets at

February 1, 2014 and February 2, 2013 at the lower of their historical net book value or their estimated fair value,

less estimated costs to sell. We expect to sell the properties within a year and we continually remarket them.

Substantially all assets held for sale are held within the Sears Domestic segment.

Impairment of Long-Lived Assets and Costs Associated with Exit Activities

In accordance with accounting standards governing the impairment or disposal of long-lived assets, the

carrying value of long-lived assets, including property and equipment and definite-lived intangible assets, is