Sears 2013 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.31

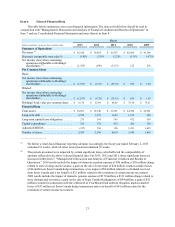

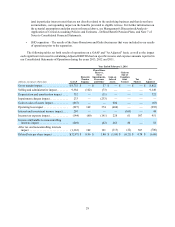

In addition to the significant items included in the Adjusted EBITDA calculation, Adjusted EPS includes the

following other significant items which, while periodically affecting our results, may vary significantly from period

to period and have a disproportionate effect in a given period, and affects comparability of results.

• Gains on sales of assets - We have recorded significant gains on sales of assets which were primarily

attributable to several real estate transactions. Management considers these gains on sale of assets to result

from investing decisions rather than ongoing operations.

• Tax Matters - In 2011, and again in 2013, we recorded a non-cash charge to establish a valuation allowance

against substantially all of our domestic deferred tax assets. Accounting rules generally require that a

valuation reserve be established when income has not been generated over a three-year cumulative period

to support the deferred tax asset. While an accounting loss was recorded, we believe no economic loss has

occurred as these net operating losses and tax benefits remain available to reduce future taxes as income is

generated in subsequent periods. As this valuation allowance has a significant impact on the effective tax

rate, we have adjusted our results to reflect a standard effective tax rate for the Company beginning in fiscal

2011 when the valuation allowance was first established.

Revenues and Comparable Store Sales

Revenues decreased $3.7 billion, or 9.2%, to $36.2 billion in 2013, as compared to revenues of $39.9 billion in

2012. The revenue decrease was primarily due to the effect of having fewer Kmart and Sears Full-line stores in

operation, which accounted for approximately $1.1 billion of the decline, as well as lower domestic comparable

store sales, which accounted for approximately $1.0 billion of the decline. Revenues for the year were also impacted

by approximately $490 million attributable to the separation of SHO, which occurred in the third quarter of 2012.

The prior year first nine months, which included the separation of SHO, included revenues of approximately $1.7

billion related to SHO merchandise sales to its customers, as well as $70 million for merchandise sold to SHO for

resale which occurred after the separation. The first nine months of 2013, included revenues from SHO of

approximately $1.3 billion, primarily related to merchandise sold to SHO for resale. Fiscal 2012 also benefited from

approximately $500 million of revenue attributable to the 53rd week. Sears Canada had a 2.7% decline in

comparable store sales during 2013, which accounted for approximately $85 million of the decline. In addition,

Sears Canada revenues experienced declines in 2013 of approximately $150 million as a result of a new licensing

arrangement related to the Sears Home Improvements Product Services ("SHIPS"), and approximately $70 million

due to the closure of four Full-line stores in Sears Canada that occurred in 2012. Finally, Sears Canada revenues in

2013 included a decrease of $157 million due to foreign currency exchange rates.

Domestic comparable store sales declined 3.8%, comprised of decreases of 3.6% at Kmart and 4.1% at Sears

Domestic. The decline at Kmart reflects declines in a majority of categories, most notably grocery & household,

consumer electronics, drugstore and toys. The decline at Sears Domestic reflects decreases in most categories

including the home appliances, consumer electronics, tools and lawn & garden categories, as well as declines at

Sears Auto Centers, partially offset by increases in the home and footwear categories.

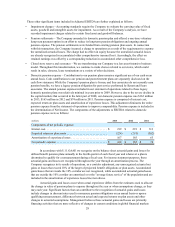

Gross Margin

Gross margin declined $1.8 billion to $8.8 billion in 2013 from $10.5 billion in 2012 due to the above noted

decline in revenues, as well as a decline in gross margin rate. Gross margin included expenses of $57 million and

$35 million in 2013 and 2012, respectively, related to store closings, while 2012 also included gross margin of $432

million from SHO. Excluding these items, gross margin decreased $1.3 billion. In addition, Sears Canada's gross

margin for 2013 included a decrease of $42 million related to the impact of foreign currency exchange rates.

The gross margin rate for both Kmart and Sears Domestic for the year were impacted by transactions that offer

both traditional promotional marketing discounts and Shop Your Way points. As compared to the prior year, Kmart's

gross margin rate for 2013 declined 170 basis points, with decreases experienced in a majority of categories,

particularly apparel and grocery & household. Sears Domestic's gross margin rate declined 260 basis points in 2013

due to selling merchandise to SHO at cost pursuant to the terms of the separation as expected and previously

disclosed, which accounted for approximately 120 basis points of the decline. Sears Domestic experienced margin

decreases in the home appliances and apparel categories. Sears Canada's gross margin rate declined 190 basis points

in 2013 due to an increase in inventory reserve requirements.