Sears 2013 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

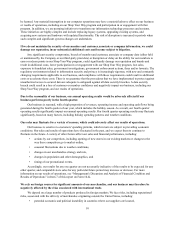

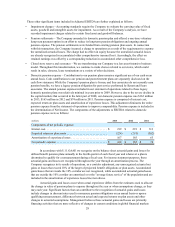

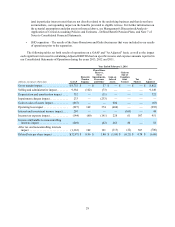

Stock Performance Graph

Comparison of Five-Year Cumulative Stockholder Return

The following graph compares the cumulative total return to stockholders on Holdings' common stock from

January 30, 2009 through January 31, 2014, the last trading day before the end of fiscal year 2013, based on the

market prices at the last trading day before the end of each fiscal year through and including fiscal year 2013 and

assuming reinvestment of the value of shares of Orchard distributed to Holdings’ shareholders on December 30,

2011, subscription rights to purchase shares of common stock of SHO distributed to Holdings’ shareholders on

October 11, 2012 and common shares of Sears Canada distributed to Holdings’ shareholders on November 13, 2012,

with the return on the S&P 500 Stock Index, the S&P 500 Retailing Index and the S&P 500 Department Stores Index

for the same period. The graph assumes an initial investment of $100 on January 30, 2009 in each of our common

stock, the S&P 500 Stock Index, the S&P Retailing Index and the S&P 500 Department Stores Index.

The S&P 500 Retailing Index consists of companies included in the S&P 500 Stock Index in the broadly

defined retail sector, which includes competing retailers of softlines (apparel and domestics) and hardlines

(appliances, electronics and home improvement products), as well as food and drug retailers. The S&P 500

Department Stores Index consists primarily of department stores that compete with our full-line stores.

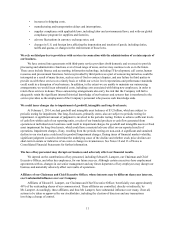

Jan. 30,

2009 Jan. 29,

2010 Jan. 28,

2011 Jan. 27,

2012 Feb. 1,

2013 Jan. 31,

2014

Sears Holdings . . . . . . . . . . . . . . . . . . . . . . . $100.00 $227.96 $185.92 $112.01 $134.58 $102.94

S&P 500 Stock Index . . . . . . . . . . . . . . . . . . $100.00 $133.12 $154.54 $159.38 $183.22 $215.84

S&P 500 Retailing Index. . . . . . . . . . . . . . . . $100.00 $155.54 $191.89 $214.72 $269.46 $333.86

S&P 500 Department Stores Index. . . . . . . . $100.00 $167.17 $187.76 $208.69 $210.82 $239.53