Sears 2013 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

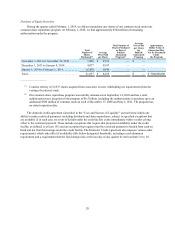

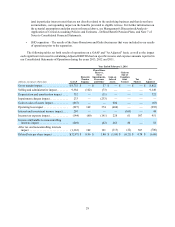

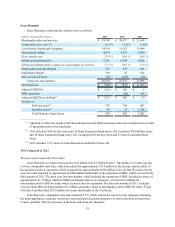

Year Ended February 2, 2013

millions, except per share

data GAAP

Domestic

Pension

Expense

Closed Store

Reserve, Store

Impairments

and Severance

Gain on

Sales of

Assets Transaction

Costs Goodwill

Impairment Pension

Settlements

Gain on

Sale of

Canadian

Joint

Venture Tax

Matters As Adjusted

- Reported SHO

Separation As

Adjusted(1)

Gross margin impact. . . $10,514 $ — $ 35 $ — $ — $ — $ — $ — $ — $ 10,549 $ (432) $ 10,117

Selling and

administrative

impact . . . . . . . . . . . 10,660 (165) (105) — (12) — (455) — — 9,923 (343) 9,580

Depreciation and

amortization impact.830 — (22) — — — — — — 808 (6) 802

Impairment charges

impact . . . . . . . . . . . 330 — (35) — — (295) — — — — — —

Gain on sales of assets

impact . . . . . . . . . . . (468) — — 419 — — — — — (49) — (49)

Operating loss impact. . (838) 165 197 (419) 12 295 455 — — (133) (83) (216)

Interest and investment

income impact. . . . . 94 — — — — — — (25) — 69 — 69

Income tax expense

impact . . . . . . . . . . . (44) (62) (74) 157 (5) — — 9 143 124 33 157

Loss attributable to

noncontrolling

interests impact . . . . 124 — (7) 8 — (145) (1) 12 — (9) — (9)

After tax and

noncontrolling

interests impact . . . . (930) 103 116 (254) 7 150 454 (4) 143 (215) (51) (266)

Diluted loss per share

impact . . . . . . . . . . . $ (8.78) $ 0.97 $ 1.09 $ (2.40) $ 0.07 $ 1.42 $ 4.29 $ (0.04) $ 1.35 $ (2.03) $ (0.48) $ (2.51)

(1) Adjusted to reflect the results of the Sears Hometown and Outlet businesses that were included in our results of operations

prior to the separation.

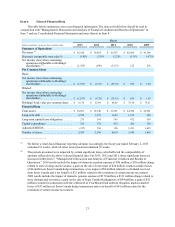

Year Ended January 28, 2012

millions, except per share data GAAP

Domestic

Pension

Expense

Closed Store

Reserve,

Store

Impairments

and

Severance

Mark-

to-

Market

Losses

Gain on

Sales of

Assets Hurricane

Losses Goodwill

Impairment Tax

Matters Discontinued

Operations

As

Adjusted -

Reported SHO

Separation As

Adjusted(1)

Gross margin impact . . . . . . . . . $10,601 $ — $ 130 $ — $ — $ — $ — — $ — $ 10,731 $ (524) $ 10,207

Selling and administrative

impact. . . . . . . . . . . . . . . . . . 10,664 (74) (124) — — (12) — — — 10,454 (459) 9,995

Depreciation and amortization

impact. . . . . . . . . . . . . . . . . . 853 — (8) — — — — — — 845 (10) 835

Impairment charges impact . . . . 649 — (98) — — — (551) — — — — —

Gain on sales of assets impact. . (64) — — — 33 — — — — (31) — (31)

Operating loss impact . . . . . . . . (1,501) 74 360 — (33) 12 551 — — (537) (55) (592)

Other loss impact. . . . . . . . . . . . (2) — — 6 — — — — — 4 — 4

Income tax expense impact . . . . (1,369) (28) (134) (2) 13 (5) — 1,819 — 294 22 316

Loss from discontinued

operations, net of tax impact (27) — — — — — — — 27 — — —

Loss attributable to

noncontrolling interest

impact. . . . . . . . . . . . . . . . . . 7 — (1) (1) — — — — — 5 — 5

After tax and noncontrolling

interest impact . . . . . . . . . . . (3,140) 46 225 3 (20) 7 551 1,819 27 (482) (33) (515)

Diluted loss per share impact. . . $ (29.40) $ 0.43 $ 2.10 $ 0.03 $ (0.19) $ 0.07 $ 5.16 $ 17.03 $ 0.25 $ (4.52) $ (0.31) $ (4.83)

(1) Adjusted to reflect the results of the Sears Hometown and Outlet businesses that were included in our results of operations

prior to the separation.

We also believe that our use of Adjusted EPS provides an appropriate measure for investors to use in assessing

our performance across periods, given that this measure provides an adjustment for certain significant items which

may vary significantly from period to period, improving the comparability of year-to-year results and is therefore

representative of our ongoing performance. Therefore, we have adjusted our results for them to make our statements

more useful and comparable. However, we do not, and do not recommend that you, solely use Adjusted EPS to

assess our financial and earnings performance. We also use, and recommend that you use, diluted earnings per share

in addition to Adjusted EPS in assessing our earnings performance.