Sears 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

• Sears Canada's sale of its 50% joint venture interests in eight properties it owned with The Westcliff

Group of Companies for consideration of approximately $0.3 billion; and

• proceeds of approximately $0.3 billion generated for other real estate transactions completed

throughout the year.

We believe that we are executing on a clear plan to increase financial flexibility, further de-risk our balance

sheet and create shareholder value. We expect to continue with these types of activities during 2014. We currently

anticipate generating approximately $500 million from an exit dividend in connection with the previously

announced separation of Lands' End through a pro rata distribution to our shareholders, with the separation being

subject to certain conditions. We currently expect that the combination of (1) the Lands' End transaction, (2) our

continuing to work with the board and management of Sears Canada to increase the value of our investment, which

has a market value as of March 14, 2014 of about $760 million, and realize significant cash proceeds and (3) our

evaluation of opportunities with respect to a potential separation of our Sears Auto Centers when taken together will

result in cash proceeds to the Company in excess of $1.0 billion in 2014, which will help fund our transformation

and create value. We also continue to reduce unprofitable stores as leases expire and, in some cases, accelerate

closings when circumstances dictate.

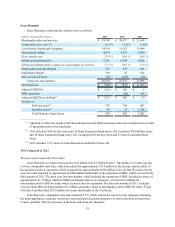

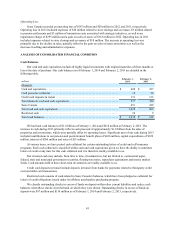

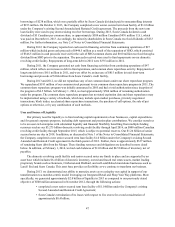

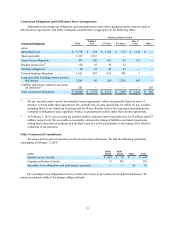

Our outstanding borrowings at February 1, 2014 and February 2, 2013 were as follows:

millions February 1,

2014 February 2,

2013

Short-term borrowings:

Unsecured commercial paper. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 9 $ 345

Secured borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,323 749

Long-term debt, including current portion:

Notes, term loan and debentures outstanding. . . . . . . . . . . . . . . . . . . . . . . . . 2,571 1,593

Capitalized lease obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 346 433

Total borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,249 $ 3,120

We fund our peak sales season working capital needs through our domestic revolving credit facility and

commercial paper markets.

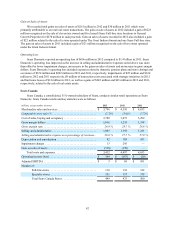

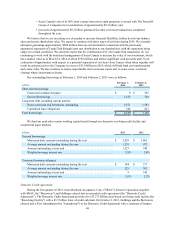

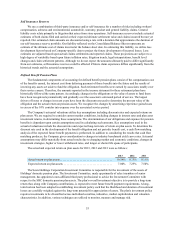

millions 2013 2012

Secured borrowings:

Maximum daily amount outstanding during the year . . . . . . . . . . . . . . . . . . $ 2,029 $ 1,862

Average amount outstanding during the year. . . . . . . . . . . . . . . . . . . . . . . . . 1,276 972

Amount outstanding at year-end . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,323 749

Weighted average interest rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.8% 2.9%

Unsecured commercial paper:

Maximum daily amount outstanding during the year . . . . . . . . . . . . . . . . . . $ 384 $ 377

Average amount outstanding during the year. . . . . . . . . . . . . . . . . . . . . . . . . 225 302

Amount outstanding at year-end . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 345

Weighted average interest rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.6% 2.2%

Domestic Credit Agreement

During the first quarter of 2011, Sears Roebuck Acceptance Corp. ("SRAC"), Kmart Corporation (together

with SRAC, the "Borrowers") and Holdings entered into an amended credit agreement (the “Domestic Credit

Agreement”). The Domestic Credit Agreement provides for a $3.275 billion asset-based revolving credit facility (the

"Revolving Facility") with a $1.5 billion letter of credit sub-limit. On October 2, 2013, Holdings and the Borrowers

entered into a First Amendment (the "Amendment") to the Domestic Credit Agreement with a syndicate of lenders.