Sears 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

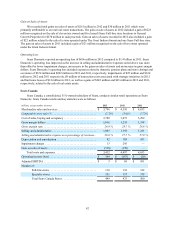

Debt Ratings

Our corporate family debt ratings at February 1, 2014 appear in the table below:

Moody’s

Investors Service Standard & Poor’s

Ratings Services Fitch Ratings

Caa1 CCC+ CCC

Domestic Pension Plan Funding

Contributions to our pension plans remain a significant use of our cash on an annual basis. While the

Company's pension plan is frozen, and thus associates do not currently earn pension benefits, the Company has a

legacy pension obligation for past service performed by Kmart and Sears associates. During 2013, we contributed

$361 million to our domestic pension plans. We estimate that the domestic pension contribution will be $487 million

in 2014 and approximately $310 million in 2015, though the ultimate amount of pension contributions could be

affected by changes in the applicable regulations as well as financial market and investment performance.

In 2012, federal legislation was signed into law which allowed pension plan sponsors to use higher interest rate

assumptions in valuing plan liabilities and determining funding obligations. As a result of this legislation, the

Company's domestic pension plan was within $203 million of being 80% funded under applicable law. In order to

reduce the risks of gross pension obligations, the Company elected to contribute an additional $203 million to its

domestic pension plan on September 14, 2012, after which its domestic pension plan was 80% funded under

applicable law.

Effective September 17, 2012, the Company amended its domestic pension plan, primarily related to lump sum

benefit eligibility, and began notifying certain former employees of the Company of its offer to pay those employees'

pension benefit in a lump sum. These amendments did not have a significant impact on our plan. Former employees

eligible for the voluntary lump sum payment option are generally those who are vested traditional formula

participants of the Plan who terminated employment prior to January 1, 2012 and who have not yet started receiving

monthly payments of their pension benefits.

The Company offered the one-time voluntary lump sum window in an effort to reduce its long-term pension

obligations and ongoing annual pension expense. This voluntary offer was made to approximately 86,000 eligible

terminated vested participants, representing approximately $2.0 billion of the Company's total qualified pension plan

liabilities. Eligible participants had until November 19, 2012 to make their election. The Company made payments

of approximately $1.5 billion to employees who made the election in December 2012 and funded the payments from

existing pension plan assets. In connection with this transaction, the Company incurred a non-cash charge to

operations of approximately $452 million pre-tax in the fourth quarter of 2012 as a result of the requirement to

expense the unrealized actuarial losses. The charge had no effect on equity because the unrealized actuarial losses

are already recognized in accumulated other comprehensive income/(loss). Accordingly, the effect on retained

earnings was offset by a corresponding reduction in accumulated other comprehensive loss.

Wholly owned Insurance Subsidiary and Intercompany Securities

We have numerous types of insurable risks, including workers' compensation, product and general liability,

automobile, warranty, asbestos and environmental claims and the extended service contracts we sell to our

customers. In addition, we provide credit insurance to third party creditors of the Company to mitigate their credit

risk with the Company. The associated risks are managed through Holdings' wholly owned insurance subsidiary,

Sears Reinsurance Company Ltd. ("Sears Re"), a Bermuda Class 3 insurer.

In accordance with applicable insurance regulations, Sears Re holds marketable securities to support the

insurance coverage it provides. Sears has utilized two securitization structures to issue specific securities in which

Sears Re has invested its capital to fund its insurance obligations. In November 2003, Sears formed a Real Estate

Mortgage Investment Conduit, or REMIC. The real estate associated with 125 Full-line stores was contributed to

indirect wholly owned subsidiaries of Sears, and then leased back to Sears. The contributed stores were mortgaged

and the REMIC issued to wholly owned subsidiaries of Sears (including Sears Re) $1.3 billion (par value) of

securities (the "REMIC Securities") that are secured by the mortgages and collateral assignments of the store leases.