Sears 2013 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

107

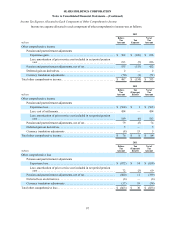

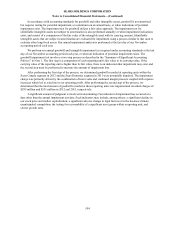

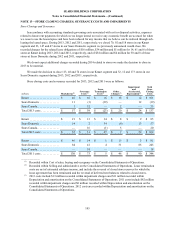

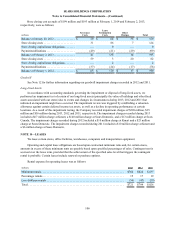

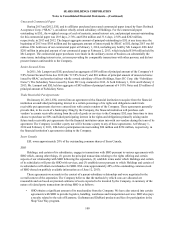

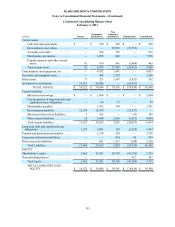

Minimum lease obligations, excluding taxes, insurance and other expenses payable directly by us, for leases in

effect at February 1, 2014, were as follows:

Minimum Lease

Commitments

millions Capital Operating

2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 102 $ 684

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90 605

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 73 499

2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51 383

2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32 289

Later years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 131 1,314

Total minimum lease payments(1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 479 3,774

Less-minimum sublease income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (128)

Net minimum lease payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,646

Less:

Estimated executory costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (41)

Interest at a weighted average rate of 6.4% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (92)

Capital lease obligations. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 346

Less current portion of capital lease obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (70)

Long-term capital lease obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 276

_____________

(1) Sears Canada: Total operating minimum lease payments of $379 million.

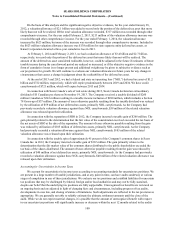

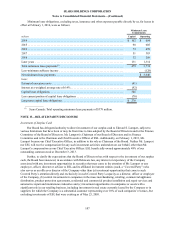

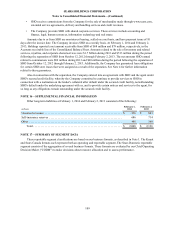

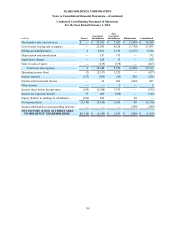

NOTE 15—RELATED PARTY DISCLOSURE

Investment of Surplus Cash

Our Board has delegated authority to direct investment of our surplus cash to Edward S. Lampert, subject to

various limitations that have been or may be from time to time adopted by the Board of Directors and/or the Finance

Committee of the Board of Directors. Mr. Lampert is Chairman of our Board of Directors and its Finance

Committee and is the Chairman and Chief Executive Officer of ESL. Additionally, on February 1, 2013, Mr.

Lampert became our Chief Executive Officer, in addition to his role as Chairman of the Board. Neither Mr. Lampert

nor ESL will receive compensation for any such investment activities undertaken on our behalf, other than Mr.

Lampert's compensation as our Chief Executive Officer. ESL beneficially owned approximately 48% of our

outstanding common stock at December 3, 2013.

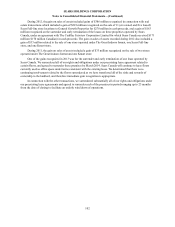

Further, to clarify the expectations that the Board of Directors has with respect to the investment of our surplus

cash, the Board has renounced, in accordance with Delaware law, any interest or expectancy of the Company

associated with any investment opportunities in securities that may come to the attention of Mr. Lampert or any

employee, officer, director or advisor to ESL and its affiliated investment entities (each, a “Covered Party”) who

also serves as an officer or director of the Company other than (a) investment opportunities that come to such

Covered Party’s attention directly and exclusively in such Covered Party’s capacity as a director, officer or employee

of the Company, (b) control investments in companies in the mass merchandising, retailing, commercial appliance

distribution, product protection agreements, residential and commercial product installation and repair services and

automotive repair and maintenance industries and (c) investment opportunities in companies or assets with a

significant role in our retailing business, including investment in real estate currently leased by the Company or in

suppliers for which the Company is a substantial customer representing over 10% of such companies’ revenues, but

excluding investments of ESL that were existing as of May 23, 2005.