Sears 2013 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

100

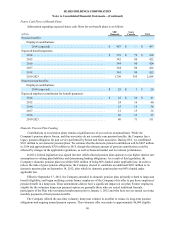

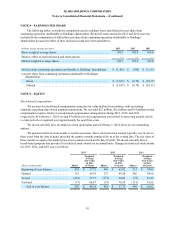

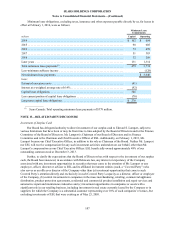

On the basis of this analysis and the significant negative objective evidence, for the year ended January 28,

2012, a valuation allowance of $2.1 billion was added to record only the portion of the deferred tax asset that more

likely than not will be realized. Of the total valuation allowance recorded, $317 million was recorded through other

comprehensive income. For the year ended February 2, 2013, $213 million of the valuation allowance increase was

recorded through other comprehensive income. For the year ended February 1, 2014, the valuation allowance

increased by $623 million, but none of the increase was recorded through other comprehensive income. Included in

the $623 million valuation allowance increase was $138 million for state separate entity deferred tax assets, as

Kmart Corporation incurred a three-year cumulative loss in 2013.

At February 1, 2014 and February 2, 2013, we had a valuation allowance of $3.4 billion and $2.7 billion,

respectively, to record only the portion of the deferred tax asset that more likely than not will be realized. The

amount of the deferred tax asset considered realizable, however, could be adjusted in the future if estimates of future

taxable income during the carryforward period are reduced or increased, or if the objective negative evidence in the

form of cumulative losses is no longer present and additional weight may be given to subjective evidence such as

our projections for growth. We will continue to evaluate our valuation allowance in future years for any change in

circumstances that causes a change in judgment about the realizability of the deferred tax asset.

At the end of 2013 and 2012, we had a federal and state net operating loss (“NOL”) deferred tax asset of $1.2

billion and $722 million, respectively, which will expire predominately between 2019 and 2034. We have credit

carryforwards of $721 million, which will expire between 2015 and 2034.

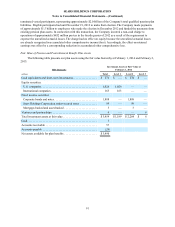

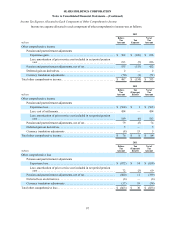

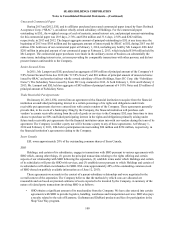

In connection with Sears Canada’s sale of real estate during 2013, Sears Canada declared an extraordinary

dividend of $5 Canadian per share on November 19, 2013. The Company received a taxable dividend of $260

million Canadian or $243 million resulting in a taxable income inclusion of $280 million, which includes a Section

78 Gross-up of $37 million. The amount of taxes otherwise payable resulting from the taxable dividend was reduced

by the utilization of $59 million of net deferred tax assets, primarily NOL carryforwards. As the Company had

previously recorded a valuation allowance against these NOL carryforwards, $59 million of the related valuation

allowance was released upon their utilization.

In connection with the separation of SHO in 2012, the Company incurred a taxable gain of $266 million. The

gain primarily related to the determination that the fair value of the consideration received exceeded the tax basis of

the net assets of SHO at the date of the separation. The amount of taxes otherwise payable resulting from the gain

was reduced by utilization of $105 million of deferred tax assets, primarily NOL carryforwards. As the Company

had previously recorded a valuation allowance against these NOL carryforwards, $105 million of the related

valuation allowance was released upon their utilization.

In connection with the taxable spin of approximately 45 percent of the Company's common shares in Sears

Canada Inc. in 2012, the Company incurred a taxable gain of $367 million. The gain primarily relates to the

determination that the fair market value of the common shares distributed to the public shareholders exceeded the

tax basis of the shares distributed. The amount of taxes otherwise payable resulting from the gain was reduced by

utilization of $40 million of net deferred tax assets, primarily NOL carryforwards. As the Company had previously

recorded a valuation allowance against these NOL carryforwards, $40 million of the related valuation allowance was

released upon their utilization.

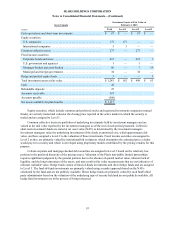

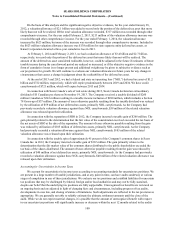

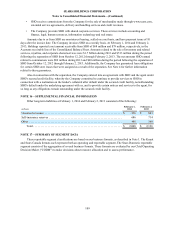

Accounting for Uncertainties in Income Taxes

We account for uncertainties in income taxes according to accounting standards for uncertain tax positions. We

are present in a large number of taxable jurisdictions, and at any point in time, can have audits underway at various

stages of completion in any of these jurisdictions. We evaluate our tax positions and establish liabilities for uncertain

tax positions that may be challenged by federal, foreign and/or local authorities and may not be fully sustained,

despite our belief that the underlying tax positions are fully supportable. Unrecognized tax benefits are reviewed on

an ongoing basis and are adjusted in light of changing facts and circumstances, including progress of tax audits,

developments in case law, and closing of statute of limitations. Such adjustments are reflected in the tax provision as

appropriate. We are generally not able to reliably estimate the ultimate settlement amounts until the close of the

audit. While we do not expect material changes, it is possible that the amount of unrecognized benefit with respect

to our uncertain tax positions will significantly increase or decrease within the next 12 months related to the audits