Sears 2013 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

108

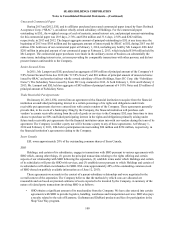

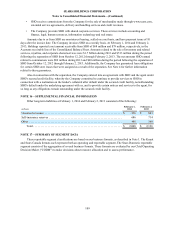

Unsecured Commercial Paper

During 2013 and 2012, ESL and its affiliates purchased unsecured commercial paper issued by Sears Roebuck

Acceptance Corp. (“SRAC”), an indirect wholly owned subsidiary of Holdings. For the commercial paper

outstanding to ESL, the weighted average of each of maturity, annual interest rate, and principal amount outstanding

for this commercial paper was 28.9 days, 2.76% and $184 million and 31.6 days, 2.38% and $202 million,

respectively, in 2013 and 2012. The largest aggregate amount of principal outstanding to ESL at any time since the

beginning of 2013 was $305 million and the aggregate amount of interest paid by SRAC to ESL during 2013 was $6

million. ESL held none of our commercial paper at February 1, 2014, including any held by Mr. Lampert. ESL held

$285 million in principal amount of our commercial paper at February 2, 2013, which included $169 million held by

Mr. Lampert. The commercial paper purchases were made in the ordinary course of business on substantially the

same terms, including interest rates, as terms prevailing for comparable transactions with other persons, and did not

present features unfavorable to the Company.

Senior Secured Notes

In 2011, Mr. Lampert and ESL purchased an aggregate of $95 million of principal amount of the Company’s 6

5/8% Senior Secured Notes due 2018 (the "6 5/8% Notes") and $10 million of principal amount of unsecured notes

issued by SRAC and another indirect wholly owned subsidiary of Sears Holdings, Sears DC Corp. (the “Subsidiary

Notes”). The Subsidiary Notes issued by Sears DC Corp. matured in 2012. At both February 1, 2014 and February 2,

2013, Mr. Lampert and ESL held an aggregate of $95 million of principal amount of 6 5/8% Notes and $3 million of

principal amount of Subsidiary Notes.

Trade Receivable Put Agreements

On January 26, 2012, ESL entered into an agreement with a financial institution to acquire from the financial

institution an undivided participating interest in a certain percentage of its rights and obligations under trade

receivable put agreements that were entered into with certain vendors of the Company. These agreements generally

provide that, in the event of a bankruptcy filing by the Company, the financial institution will purchase such

vendors’ accounts receivable arising from the sale of goods or services to the Company. ESL may from time to time

choose to purchase an 80% undivided participating interest in the rights and obligations primarily arising under

future trade receivable put agreements that the financial institution enters into with our vendors during the term of its

agreement. The Company is neither a party nor will it become a party to any of these agreements. At February 1,

2014 and February 2, 2013, ESL held a participation interest totaling $80 million and $234 million, respectively, in

the financial institution’s agreements relating to the Company.

Sears Canada

ESL owns approximately 28% of the outstanding common shares of Sears Canada.

SHO

Holdings, and certain of its subsidiaries, engage in transactions with SHO pursuant to various agreements with

SHO which, among other things, (1) govern the principal transactions relating to the rights offering and certain

aspects of our relationship with SHO following the separation, (2) establish terms under which Holdings and certain

of its subsidiaries will provide SHO with services, and (3) establish terms pursuant to which Holdings and certain of

its subsidiaries will obtain merchandise for SHO. ESL owns approximately 48% of the outstanding common stock

of SHO (based on publicly available information as of June 12, 2013).

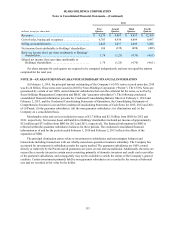

These agreements were made in the context of a parent-subsidiary relationship and were negotiated in the

overall context of the separation. The Company believes that the methods by which costs are allocated are

reasonable and are based on prorated estimates of costs expected to be incurred by the Company. A summary of the

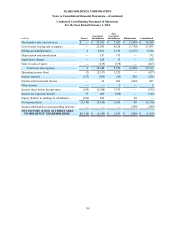

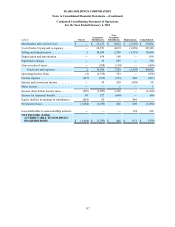

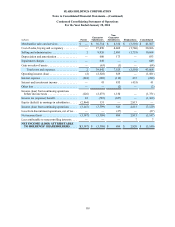

nature of related party transactions involving SHO is as follows:

• SHO obtains a significant amount of its merchandise from the Company. We have also entered into certain

agreements with SHO to provide logistics, handling, warehouse and transportation services. SHO also pays

a royalty related to the sale of Kenmore, Craftsman and DieHard products and fees for participation in the

Shop Your Way program.