Sears 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.41

2013 was driven by the above noted decline in sales and gross margin, partially offset by a decrease in selling and

administrative expenses.

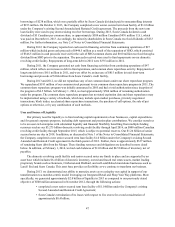

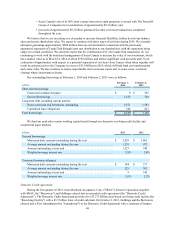

2012 Compared to 2011

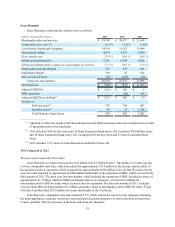

Revenues and Comparable Store Sales

Sears Domestic’s revenues decreased by $672 million as comparable store sales decreased 1.4%, which

accounted for approximately $200 million of the decline. The decline in revenue is mainly due to the impact of

having fewer Sears Full-line stores in operation, which accounted for approximately $530 million, the decline in

comparable store sales and the separation of the Sears Hometown and Outlet businesses, partially offset by the

inclusion of approximately $275 million of revenues recorded in the 53rd week of 2012. The separation of the Sears

Hometown and Outlet businesses resulted in a net decrease in revenues of approximately $100 million.

The decrease of 1.4% in comparable store sales was driven by decreases in the consumer electronics, lawn and

garden and home appliances categories, as well as at Sears Auto Centers. These decreases were partially offset by

increases in apparel and home. Consumer electronics continues to be negatively impacted by price compression, as

well as market shifts such as moves to smartphone technology and away from digital cameras, GPS devices, MP3

Players and camcorders in addition to transitions to online gaming and applications. Excluding the consumer

electronics category, Sears Domestic comparable stores sales decreased only 0.1%.

Gross Margin

Sears Domestic generated gross margin dollars of $5.9 billion in 2012 and $5.8 billion in 2011 as the decline in

revenues in 2012 noted above was offset by an improvement in gross margin rate. Gross margin for 2012 and 2011

included charges of $14 million and $84 million, respectively, for markdowns recorded in connection with store

closings.

Sears Domestic’s gross margin rate was 28.0% in 2012 and 26.8% in 2011. The increase of 120 basis points

was mainly due to improvements in the apparel, home appliance and footwear categories, which were partially offset

by declines in the consumer electronics category and our Lands' End customer direct business.

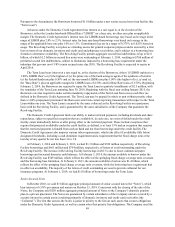

Selling and Administrative Expenses

Sears Domestic’s selling and administrative expenses increased $142 million in 2012 as compared to 2011.

Selling and administrative expenses for 2012 were impacted by expenses of $617 million related to pension plans

and $30 million related to store closings and severance, while 2011 was impacted by expenses of $74 million related

to pension plans and $76 million related to store closings and severance. Selling and administrative expenses for

2012 also included $9 million of transaction costs associated with strategic initiatives while 2011 included expense

of $12 million related to hurricane losses. Excluding these items, selling and administrative expenses decreased

$352 million due to declines in advertising and payroll expenses.

Sears Domestic’s selling and administrative expense rate was 29.5% in 2012 and 27.9% in 2011 and increased

as a result of the above noted increase in significant items.

Depreciation and Amortization

Depreciation and amortization expense decreased $23 million to $578 million during 2012 and included

charges of $13 million and $8 million in 2012 and 2011, respectively, taken in connection with store closings. The

decrease is primarily attributable to having fewer assets available for depreciation.

Impairment Charges

During 2012, we recorded impairment charges of $25 million related to the impairment of long-lived assets.

We also recorded impairment charges during 2011 of $551 million and $98 million related to the impairment of

goodwill and long-lived assets, respectively. Impairment charges recorded in both years are described further in

Notes 12 and 13 in Notes to Consolidated Financial Statements.