Sears 2013 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

84

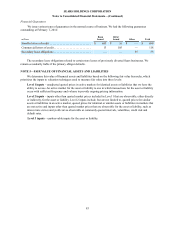

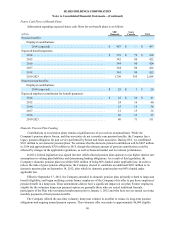

Accounts receivable, merchandise payables, short-term borrowings, accrued liabilities and domestic cash and

cash equivalents are reflected in the Consolidated Balance Sheets at cost, which approximates fair value due to the

short-term nature of these instruments. The fair value of our debt is disclosed in Note 3 to the Consolidated

Financial Statements. The fair value of pension and other postretirement benefit plan assets is disclosed in Note 7 to

the Consolidated Financial Statements. The following tables provide the fair value measurement amounts for other

financial assets recorded in our Consolidated Balance Sheets at fair value at February 1, 2014 and February 2, 2013:

Total Fair Value

Amounts at

millions February 1, 2014 Level 1 Level 2 Level 3

Cash equivalents(1) . . . . . . . . . . . . . . . . . . . . . . $ 346 $ 346 $ — $ —

Restricted cash(2). . . . . . . . . . . . . . . . . . . . . . . . 10 10 — —

Foreign currency derivative assets(3) . . . . . . . . 8 — 8 —

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 364 $ 356 $ 8 $ —

Total Fair Value

Amounts at

millions February 2, 2013 Level 1 Level 2 Level 3

Cash equivalents(1) . . . . . . . . . . . . . . . . . . . . . . $ 181 $ 181 $ — $ —

Restricted cash(2). . . . . . . . . . . . . . . . . . . . . . . . 9 9 — —

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 190 $ 190 $ — $ —

__________________

(1) Included within Cash and cash equivalents on the Consolidated Balance Sheets.

(2) Included within Restricted cash on the Consolidated Balance Sheets.

(3) Included within Prepaid expenses and other current assets on the Consolidated Balance Sheets.

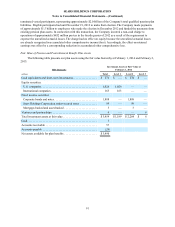

The fair values of derivative assets and liabilities traded in the over-the-counter market are determined using

quantitative models that require the use of multiple inputs including interest rates, prices and indices to generate

pricing and volatility factors. The predominance of market inputs are actively quoted and can be validated through

external sources, including brokers, market transactions and third-party pricing services. Our derivative instruments

are valued using Level 2 measurements.

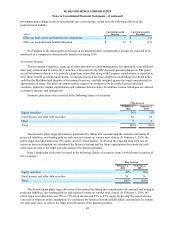

Assets and Liabilities that are Measured at Fair Value on a Nonrecurring Basis

Assets and liabilities that are measured at fair value on a nonrecurring basis relate primarily to our tangible

fixed assets, goodwill and other intangible assets, which are remeasured when the derived fair value is below

carrying value on our Consolidated Balance Sheets. For these assets, we do not periodically adjust carrying value to

fair value except in the event of impairment. When we determine that impairment has occurred, we measure the

impairment and adjust the carrying value as discussed in Note 1. With the exception of the goodwill and fixed asset

impairments described in Note 12 and Note 13, respectively, we had no significant remeasurements of such assets or

liabilities to fair value during 2013 and 2012.

All of the fair value remeasurements were based on significant unobservable inputs (Level 3). Fixed asset fair

values were derived based on discussions with real estate brokers, review of comparable properties, if available, and

internal expertise related to the current marketplace conditions. Inputs for the goodwill included discounted cash

flow analyses, comparable marketplace fair value data, as well as management's assumptions in valuing significant

tangible and intangible assets, as described in Note 1, Summary of Significant Accounting Policies.