Sears 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

77

Company in the first quarter of 2013 and impacted the Company's disclosures, but otherwise did not have a material

impact on the Company’s condensed consolidated financial position, results of operations or cash flows.

NOTE 2—SEARS CANADA

Sears Holdings Ownership of Sears Canada

At February 1, 2014 and February 2, 2013, Sears Holdings was the beneficial holder of approximately 52

million, or 51% of the common shares of Sears Canada.

Partial Spin-Off

On November 13, 2012, we completed a partial spin-off (the “spin-off”) of our interest in Sears Canada. Prior

to the spin-off, Holdings beneficially owned approximately 96% of the issued and outstanding common shares of

Sears Canada. In connection with the spin-off, we distributed approximately 45 million common shares of Sears

Canada held by Holdings on a pro rata basis to holders of Holdings' common stock. Following the spin-off,

Holdings was the beneficial holder of approximately 51% of the issued and outstanding common shares of Sears

Canada, and as such, Holdings has maintained control of Sears Canada and will continue to consolidate the results

of Sears Canada. We accounted for the spin-off as an equity transaction in accordance with accounting standards

applicable to noncontrolling interests. Accordingly, we reclassified a portion of our ownership interest in Sears

Canada and accumulated other comprehensive loss to noncontrolling interest in the Consolidated Statement of

Equity for the period ended February 2, 2013.

Sears Canada Share Repurchases

During the second quarter of 2013, Sears Canada renewed its Normal Course Issuer Bid with the Toronto

Stock Exchange that permits it to purchase for cancellation up to 5% of its issued and outstanding common shares,

representing approximately 5.1 million common shares. The purchase authorization expires on May 23, 2014, or on

such earlier data as Sears Canada may complete its purchases pursuant to the Normal Course Issuer bid. There were

no share purchases during 2013. As part of a Normal Course Issuer bid in place for the period from May 25, 2011 to

May 24, 2012, and then canceled, Sears Canada purchased and canceled approximately 0.9 million common shares

for $10 million and approximately 2.7 million common shares for $43 million during 2012 and 2011, respectively.

Dividends

On November 19, 2013, Sears Canada announced that its Board of Directors declared a cash dividend of $5

Canadian per common share, or approximately $509 million Canadian ($476 million U.S.), which was paid on

December 6, 2013 to shareholders of record at the close of business on December 2, 2013. Accordingly, the

Company received dividends of $243 million and minority shareholders in Sears Canada received dividends of $233

million during the fourth quarter of 2013.

On December 12, 2012, Sears Canada announced that its Board of Directors declared a cash dividend of $1

Canadian per common share, or approximately $102 million Canadian ($102 million U.S.) which was paid on

December 31, 2012 to shareholders of record at the close of business on December 24, 2012. Accordingly, the

Company received dividends of $52 million and minority shareholders in Sears Canada received dividends of $50

million during the fourth quarter of 2012.

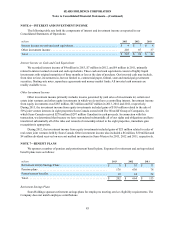

NOTE 3—BORROWINGS

Total borrowings outstanding at February 1, 2014 and February 2, 2013 were $4.2 billion and $3.1 billion,

respectively. At February 1, 2014, total short-term borrowings were $1.3 billion, consisting of $1.3 billion secured

borrowings and $9 million of unsecured commercial paper. At February 2, 2013, total short-term borrowings were

$1.1 billion, consisting of $749 million secured borrowings and $345 million of unsecured commercial paper. The

weighted-average annual interest rate paid on short-term debt was 2.8% in 2013 and 2.7% in 2012.