Sears 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

Self Insurance Reserves

We use a combination of third-party insurance and/or self-insurance for a number of risks including workers'

compensation, asbestos and environmental, automobile, warranty, product and general liability claims. General

liability costs relate primarily to litigation that arises from store operations. Self-insurance reserves include actuarial

estimates of both claims filed and carried at their expected ultimate settlement value and claims incurred but not yet

reported. Our estimated claim amounts are discounted using a rate with a duration that approximates the duration of

our self-insurance reserve portfolio. Our liability reflected on the Consolidated Balance Sheets represents an

estimate of the ultimate cost of claims incurred at the balance sheet date. In estimating this liability, we utilize loss

development factors based on Company-specific data to project the future development of incurred losses. Loss

estimates are adjusted based upon actual claims settlements and reported claims. These projections are subject to a

high degree of variability based upon future inflation rates, litigation trends, legal interpretations, benefit level

changes and claim settlement patterns. Although we do not expect the amounts ultimately paid to differ significantly

from our estimates, self-insurance reserves could be affected if future claim experience differs significantly from the

historical trends and the actuarial assumptions.

Defined Benefit Pension Plans

The fundamental components of accounting for defined benefit pension plans consist of the compensation cost

of the benefits earned, the interest cost from deferring payment of those benefits into the future and the results of

investing any assets set aside to fund the obligation. Such retirement benefits were earned by associates ratably over

their service careers. Therefore, the amounts reported in the income statement for these retirement plans have

historically followed the same pattern. Accordingly, changes in the obligations or the value of assets to fund them

have been recognized systematically and gradually over the associate's estimated period of service. The largest

drivers of losses or charges in recent years have been the discount rate used to determine the present value of the

obligation and the actual return on pension assets. We recognize the changes by amortizing experience gains/losses

in excess of the 10% corridor into expense over the associated service period.

The Company's actuarial valuations utilize key assumptions including discount rates and expected returns on

plan assets. We are required to consider current market conditions, including changes in interest rates and plan asset

investment returns, in determining these assumptions. The determination of our obligations and expense for pension

benefits is dependent upon certain assumptions used in calculating such amounts. Key assumptions used in the

actuarial valuations include the discount rate and expected long-term rate of return on plan assets. To determine the

discount rate used in the development of the benefit obligation and net periodic benefit cost, a cash flow matching

analysis of the expected future benefit payments is performed. In addition to considering the results that cash flow

matching produces, the Company gives consideration to changes in industry benchmark yield curve rates. Actuarial

assumptions may differ materially from actual results due to changing market and economic conditions, changes in

investment strategies, higher or lower withdrawal rates, and longer or shorter life spans of participants.

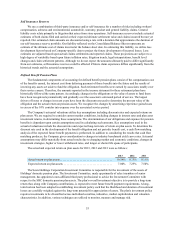

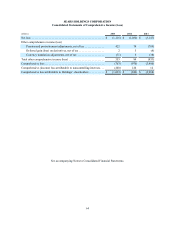

The actual and expected return on plan assets for 2013, 2012 and 2011 were as follows:

2013 2012 2011

Actual return on plan assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.54% 9.75% 0.11%

Expected return on plan assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.00% 7.25% 7.50%

The Sears Holdings Corporation Investment Committee is responsible for the investment of the assets of

Holdings' domestic pension plan. The Investment Committee, made up primarily of select members of senior

management, has appointed a non-affiliated third party professional to advise the Investment Committee with

respect to the SHC domestic pension plan assets. The plan's overall investment objective is to provide a long-term

return that, along with Company contributions, is expected to meet future benefit payment requirements. A long-

term horizon has been adopted in establishing investment policy such that the likelihood and duration of investment

losses are carefully weighed against the long-term potential for appreciation of assets. The plan's investment policy

requires investments to be diversified across individual securities, industries, market capitalization and valuation

characteristics. In addition, various techniques are utilized to monitor, measure and manage risk.