Sears 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

81

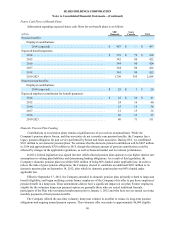

Sears Canada Facility is determined pursuant to a borrowing base formula based on inventory and credit card

receivables, subject to certain limitations. At February 1, 2014 and February 2, 2013 we had no borrowings

outstanding under the Sears Canada Facility. Availability under this agreement was approximately $336 million

($374 million Canadian) and $503 million ($502 million Canadian), respectively, at February 1, 2014 and

February 2, 2013. The current availability may be reduced by reserves currently estimated by the Company to be

approximately $177 million, which may be applied by the lenders at their discretion pursuant to the Credit Facility

agreement. As a result of judicial developments relating to the priorities of pension liability relative to certain

secured obligations, Sears Canada has executed an amendment to the Sears Canada Credit Facility which would

provide additional security to lenders, with respect to the Company's unfunded pension liability by pledging certain

real estate assets as collateral thereby partially reducing the potential reserve amounts by up to $135 million the

lenders could apply. The potential additional reserve amount may increase or decrease in the future based on

estimated net pension liabilities.

Cash Collateral

We post cash collateral for certain self-insurance programs. We continue to classify the cash collateral posted

for self-insurance programs as cash and cash equivalents due to our ability to substitute letters of credit for the cash

at any time at our discretion. At February 1, 2014 and February 2, 2013, $18 million and $19 million of cash,

respectively, was posted as collateral for self-insurance programs.

Wholly owned Insurance Subsidiary and Intercompany Securities

We have numerous types of insurable risks, including workers’ compensation, product and general liability,

automobile, warranty, asbestos and environmental claims and the extended service contracts we sell to our

customers. In addition, we provide credit insurance to third party creditors of the Company to mitigate their credit

risk with the Company. The associated risks are managed through Holdings’ wholly owned insurance subsidiary,

Sears Reinsurance Company Ltd. (“Sears Re”), a Bermuda Class 3 insurer.

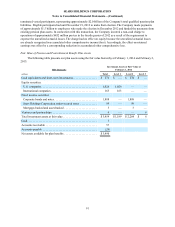

In accordance with applicable insurance regulations, Sears Re holds marketable securities to support the

insurance coverage it provides. Sears has utilized two securitization structures to issue specific securities in which

Sears Re has invested its capital to fund its insurance obligations. In November 2003, Sears formed a Real Estate

Mortgage Investment Conduit, or REMIC. The real estate associated with 125 Full-line stores was contributed to

indirect wholly owned subsidiaries of Sears, and then leased back to Sears. The contributed stores were mortgaged

and the REMIC issued to wholly owned subsidiaries of Sears (including Sears Re) $1.3 billion (par value) of

securities (the “REMIC Securities”) that are secured by the mortgages and collateral assignments of the store leases.

Payments to the holders on the REMIC Securities are funded by the lease payments. In May 2006, a subsidiary of

Holdings contributed the rights to use the Kenmore, Craftsman and DieHard trademarks in the U.S. and its

possessions and territories to KCD IP, LLC, an indirect wholly owned subsidiary of Holdings. KCD IP, LLC has

licensed the use of the trademarks to subsidiaries of Holdings, including Sears and Kmart. Asset-backed securities

with a par value of $1.8 billion (the “KCD Securities”) were issued by KCD IP, LLC and subsequently purchased by

Sears Re, the collateral for which includes the trademark rights and royalty income. Payments to the holders on the

KCD Securities are funded by the royalty payments. The issuers of the REMIC Securities and KCD Securities and

the owners of these real estate and trademark assets are bankruptcy remote, special purpose entities that are indirect

wholly owned subsidiaries of Holdings. Cash flows received from rental streams and licensing fee streams paid by

Sears, Kmart, other affiliates and third parties, are used for the payment of fees and interest on these securities. In

the fourth quarter of fiscal 2013, Holdings contributed all of the outstanding capital stock of Sears Re to SRe

Holding Corporation, a direct wholly owned subsidiary of Holdings. Sears Re thereafter reduced its excess statutory

capital through the distribution of all REMIC Securities held by it to SRe Holding Corporation. Since the inception

of the REMIC and KCD IP, LLC, the REMIC Securities and the KCD Securities have been entirely held by our

wholly owned consolidated subsidiaries. At February 1, 2014 and February 2, 2013, the net book value of the

securitized trademark rights was approximately $1.0 billion. The net book value of the securitized real estate assets

was approximately $0.7 billion at February 1, 2014 and $0.8 billion at February 2, 2013.