Sears 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

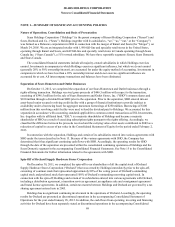

Notes to Consolidated Financial Statements—(Continued)

73

Hedges of Foreign Currency

The foreign currency forward contracts are recorded on the Consolidated Balance Sheet at fair value and, to

the extent they have been designated and qualify for hedge accounting treatment, an offsetting amount is recorded as

a component of other comprehensive income (loss), net of income tax effects. Changes in the fair value of those

forward contracts for which hedge accounting is not applied are recorded in the Consolidated Statements of

Operations as a component of other income (loss). Certain of our currency forward contracts require collateral to be

posted in the event our liability under such contracts reaches a predetermined threshold. Cash collateral posted under

these contracts is recorded as part of our restricted cash balance.

Counterparty Credit Risk

We actively manage the risk of nonpayment by our derivative counterparties by limiting our exposure to

individual counterparties based on credit ratings, value at risk and maturities. The counterparties to these instruments

are major financial institutions with investment grade credit ratings or better at February 1, 2014.

Fair Value of Financial Instruments

We determine the fair value of financial instruments in accordance with standards pertaining to fair value

measurements. Such standards define fair value and establish a framework for measuring fair value in GAAP. Under

fair value measurement accounting standards, fair value is considered to be the exchange price in an orderly

transaction between market participants to sell an asset or transfer a liability at the measurement date. We report the

fair value of financial assets and liabilities based on the fair value hierarchy prescribed by accounting standards for

fair value measurements, which prioritizes the inputs to valuation techniques used to measure fair value into three

levels. See Note 4 for further information regarding our derivative positions.

Financial instruments that potentially subject the Company to concentration of credit risk consist principally of

temporary cash investments, accounts receivable and derivative financial instruments. We place our cash and cash

equivalents in investment-grade, short-term instruments with high quality financial institutions and, by policy, limit

the amount of credit exposure in any one financial instrument. We use high credit quality counterparties to transact

our derivative transactions.

Cash and cash equivalents, accounts receivable, merchandise payables, credit facility borrowings and accrued

liabilities are reflected in the Consolidated Balance Sheet at cost, which approximates fair value due to the short-

term nature of these instruments. The fair value of our debt is disclosed in Note 3.