Sears 2013 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

80

the remainder of the Term Loan maturing June 30, 2018. Beginning with the fiscal year ending January 2015, the

Borrowers are also required to make certain mandatory repayments of the Term Loan from excess cash flow (as

defined in the Domestic Credit Agreement). The Term Loan may be prepaid in whole or part without penalty, other

than a 1.00% prepayment premium if the Borrowers enter into certain repricing transactions with respect to the Term

Loan within one year. The Term Loan is secured by the same collateral as the Revolving Facility on a pari passu

basis with the Revolving Facility, and is guaranteed by the same subsidiaries of the Company that guarantee the

Revolving Facility.

The Domestic Credit Agreement limits our ability to make restricted payments, including dividends and share

repurchases, subject to specified exceptions that are available if, in each case, no event of default under the credit

facility exists immediately before or after giving effect to the restricted payment. These include exceptions that

require that projected availability under the credit facility, as defined, is at least 15% and an exception that requires

that the restricted payment is funded from cash on hand and not from borrowings under the credit facility. The

Domestic Credit Agreement also imposes various other requirements, which take effect if availability falls below

designated thresholds, including a cash dominion requirement and a requirement that the fixed charge ratio at the

last day of any quarter be not less than 1.0 to 1.0.

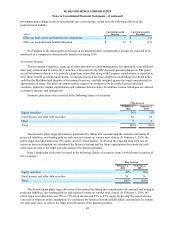

At February 1, 2014 and February 2, 2013, we had $1.3 billion and $749 million respectively, of Revolving

Facility borrowings and $661 million and $754 million, respectively, of letters of credit outstanding under the

Revolving Facility. At February 1, 2014, the amount available to borrow under the Revolving Facility was $549

million, which reflects the effect of the springing fixed charge coverage ratio covenant and the borrowing base

limitation. At February 2, 2013, the amount available to borrow was $1.4 billion, which reflects the effect of the

springing fixed charge coverage ratio covenant, while the borrowing base requirement had no effect on availability.

The majority of the letters of credit outstanding are used to provide collateral for our insurance programs. At

February 1, 2014, we had $1.0 billion of borrowings under the Term Loan.

Senior Secured Notes

In October 2010, we sold $1 billion aggregate principal amount of senior secured notes (the “Notes”), which

bear interest at 6 5/8% per annum and mature on October 15, 2018. Concurrent with the closing of the sale of the

Notes, the Company sold $250 million aggregate principal amount of Notes to the Company’s domestic pension

plan in a private placement. The Notes are guaranteed by certain subsidiaries of the Company and are secured by a

security interest in certain assets consisting primarily of domestic inventory and credit card receivables (the

“Collateral”). The lien that secures the Notes is junior in priority to the lien on such assets that secures obligations

under the Domestic Credit Agreement, as well as certain other first priority lien obligations. The Company used the

net proceeds of this offering to repay borrowings outstanding under a previous domestic credit agreement on the

settlement date and to fund the working capital requirements of our retail businesses, capital expenditures and for

general corporate purposes. The indenture under which the Notes were issued contains restrictive covenants that,

among other things, (1) limit the ability of the Company and certain of its domestic subsidiaries to create liens and

enter into sale and leaseback transactions and (2) limit the ability of the Company to consolidate with or merge into,

or sell other than for cash or lease all or substantially all of its assets to, another person. The indenture also provides

for certain events of default, which, if any were to occur, would permit or require the principal and accrued and

unpaid interest on all the then outstanding notes to be due and payable immediately. Generally, the Company is

required to offer to repurchase all outstanding Notes at a purchase price equal to 101% of the principal amount if the

borrowing base (as calculated pursuant to the indenture) falls below the principal value of the notes plus any other

indebtedness for borrowed money that is secured by liens on the Collateral for two consecutive quarters or upon the

occurrence of certain change of control triggering events. The Company may call the Notes at a premium based on

the “Treasury Rate” as defined in the indenture, plus 50 basis points. On September 6, 2011, we completed our offer

to exchange the Notes held by nonaffiliates for a new issue of substantially identical notes registered under the

Securities Act of 1933, as amended.

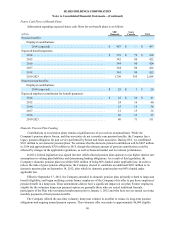

Sears Canada Credit Agreement

In September 2010, Sears Canada entered into a five-year, $800 million Canadian senior secured revolving

credit facility (the “Sears Canada Facility”). The Sears Canada Facility is available for Sears Canada’s general

corporate purposes and is secured by a first lien on inventory and credit card receivables. Availability under the