Sears 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

76

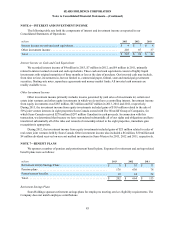

other sources, including gain from pension and other postretirement benefits recorded as a component of OCI, is

considered when determining whether sufficient future taxable income exists to realize the deferred tax assets.

Stock-based Compensation

We account for stock-based compensation arrangements in accordance with accounting standards pertaining to

share-based payment transactions, which requires us to both recognize as expense the fair value of all stock-based

compensation awards (which includes stock options, although there were no options outstanding in 2013) and to

classify excess tax benefits associated with share-based compensation deductions as cash from financing activities

rather than cash from operating activities. We recognize compensation expense as awards vest on a straight-line

basis over the requisite service period of the award.

Earnings Per Common Share

Basic earnings per common share is calculated by dividing net income attributable to Holdings' shareholders

by the weighted average number of common shares outstanding for each period. Diluted earnings per common share

also includes the dilutive effect of potential common shares, exercise of stock options and the effect of restricted

stock when dilutive.

New Accounting Pronouncements

Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a

Tax Credit Carryforward Exists

In July 2013, the Financial Accounting Standards Board ("FASB") issued an accounting standards update

which requires an unrecognized tax benefit to be presented as a reduction to a deferred tax asset for a net operating

loss carryforward, a similar tax loss or a tax credit carryforward that the entity intends to use and is available for

settlement at the reporting date. The update will be effective for the Company in the first quarter of 2014 and is not

expected to have a material impact on the Company's condensed consolidated financial position, results of

operations or cash flows.

Disclosures about Reclassification Adjustments out of Accumulated Other Comprehensive Income

In February 2013, the FASB issued an accounting standards update which adds new disclosure requirements for

items reclassified out of accumulated other comprehensive income. The update requires entities to disclose

additional information about reclassification adjustments, including changes in accumulated other comprehensive

income balances by component and significant items reclassified out of accumulated other comprehensive income.

The update was effective and adopted by the Company in the first quarter of 2013 and impacted the Company's

disclosures, but otherwise did not have a material impact on the Company's condensed consolidated financial

position, results of operations or cash flows.

Testing Indefinite-Lived Intangible Assets for Impairment

In July 2012, the FASB issued an accounting standards update which provides, subject to certain conditions, the

option to perform a qualitative, rather than quantitative, assessment to determine whether it is more likely than not

that the fair value of an indefinite-lived intangible asset is less than its carrying amount. This update was effective

and adopted by the Company in the first quarter of 2013 and did not have a material impact on the Company's

condensed consolidated financial position, results of operations or cash flows.

Disclosures about Offsetting Assets and Liabilities

In December 2011, the FASB issued an accounting standards update which requires disclosures of gross and net

information about financial derivative instruments eligible for offset in the statement of financial position or subject

to a master netting agreement. In January 2013, the FASB issued an accounting standards update which narrows the

scope of the disclosure requirements to derivatives, securities borrowings, and securities lending transactions that

are either offset or subject to a master netting arrangement. This update was effective for and adopted by the