Sears 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.40

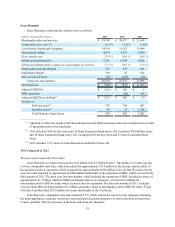

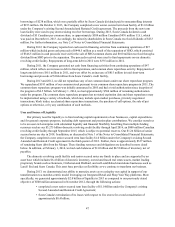

Gross Margin

Sears Domestic generated gross margin dollars of $4.9 billion and $5.9 billion in 2013 and 2012, respectively.

Gross margin for 2013 and 2012 included charges related to store closures of $11 million and $14 million,

respectively. The prior year also included gross margin of $432 million from SHO. Excluding these items, gross

margin decreased $567 million.

Sears Domestic’s gross margin rate was 25.4% in 2013 and 28.0% in 2012. The decrease of 260 basis points in

2013 was due to selling merchandise to SHO at cost pursuant to the terms of the separation as expected and

previously disclosed, which accounted for approximately 120 basis points of the decline. Gross margin rate was also

impacted by transactions that offer both traditional promotional marketing discounts and Shop Your Way Points.

Sears Domestic experienced margin decreases in the home appliances and apparel categories.

Selling and Administrative Expenses

Sears Domestic’s selling and administrative expenses decreased $968 million in 2013 as compared to 2012.

Selling and administrative expenses were impacted by expenses related to domestic pension plans, store closings

and severance of $120 million and $647 million in 2013 and 2012, respectively. The prior year also included

expenses of $343 million related to SHO and $9 million of transactions costs associated with strategic initiatives.

Excluding these items, selling and administrative expenses decreased by $89 million primarily due to a decline in

payroll expenses.

Sears Domestic’s selling and administrative expense rate was 27.2% in 2013 and 29.5% in 2012 and decreased

as a result of the above noted significant items.

Depreciation and Amortization

Depreciation and amortization expense decreased $67 million in 2013 to $511 million and included charges of

$2 million and $13 million in 2013 and 2012, respectively, taken in connection with store closings. The decrease is

primarily attributable to having fewer assets available for depreciation.

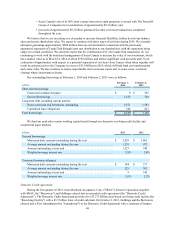

Impairment Charges

Sears Domestic recorded impairment charges of $150 million and $25 million in 2013 and 2012, respectively,

related to the impairment of long-lived assets. Impairment charges recorded in both years are described further in

Notes 12 and 13 in Notes to Consolidated Financial Statements.

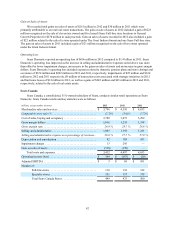

Gain on Sales of Assets

Sears Domestic recorded total gains on sales of assets of $63 million in 2013 and $261 million in 2012 which

were primarily attributable to several real estate transactions. The gain on sales of assets in 2013 included a gain of

$43 million related to the sale of a store previously operated under The Great Indoors format and two Sears Full-line

stores for which the Company received $74 million in proceeds. The gain on sales of assets in 2012 included a gain

of $223 million recognized on the sale of eleven (six owned and five leased) Sears Full-line store locations to

General Growth Properties for $270 million in cash proceeds. Gain on sales of assets recorded in 2012 also included

a gain of $22 million related to the sale of a store operated under The Great Indoors format and one Sears Full-line

store.

Operating Loss

Sears Domestic reported an operating loss of $940 million in 2013 compared to $656 million in 2012. Sears

Domestic’s operating loss in 2013 included expenses related to domestic pension plans, store closings, store

impairments and severance, as well as gains on the sales of assets which aggregated to an operating loss of $240

million. Operating loss in 2012 included expenses related to domestic pension plans, store closings, store

impairments, severance and transaction costs, as well as gains on the sales of assets and operating income from SHO

which aggregated to an operating loss $380 million. Excluding these items, Sears Domestic would have reported an

operating loss of $700 million and $276 million in 2013 and 2012 respectively. The increase in operating loss in