Sears 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.49

Pursuant to the Amendment, the Borrowers borrowed $1.0 billion under a new senior secured term loan facility (the

"Term Loan").

Advances under the Domestic Credit Agreement bear interest at a rate equal to, at the election of the

Borrowers, either the London Interbank Offered Rate (“LIBOR”) or a base rate, in either case plus an applicable

margin. The Domestic Credit Agreement’s interest rates for LIBOR-based borrowings vary based on leverage in the

range of LIBOR plus 2.0% to 2.5%. Interest rates for base rate-based borrowings vary based on leverage in the

range of the applicable base rate plus 1.0% to 1.5%. Commitment fees are in a range of 0.375% to 0.625% based on

usage. The Revolving Facility is in place as a funding source for general corporate purposes and is secured by a first

lien on most of our domestic inventory and credit card and pharmacy receivables, and is subject to a borrowing base

formula to determine availability. The Revolving Facility permits aggregate second lien indebtedness of up to $2.0

billion, of which $1.2 billion in second lien notes were outstanding at February 1, 2014, resulting in $760 million of

permitted second lien indebtedness, subject to limitations imposed by a borrowing base requirement under the

indenture that governs our 6 5/8% senior secured notes due 2018. The Revolving Facility is expected to expire in

April 2016.

The Term Loan bears interest at a rate equal to, at the election of the Borrowers, either (1) LIBOR (subject to a

1.00% LIBOR floor) or (2) the highest of (x) the prime rate of the bank acting as agent of the syndicate of lenders

(y) the federal funds rate plus 0.50% and (z) the one-month LIBOR rate plus 1.00% (the highest of (x), (y) and (z),

the "Base Rate"), plus an applicable margin for LIBOR loans of 4.50% and for Base Rate loans of 3.50%. Beginning

February 2, 2014, the Borrowers are required to repay the Term Loan in quarterly installments of $2.5 million, with

the remainder of the Term Loan maturing June 30, 2018. Beginning with the fiscal year ending January 2015, the

Borrowers are also required to make certain mandatory repayments of the Term Loan from excess cash flow (as

defined in the Domestic Credit Agreement). The Term Loan may be prepaid in whole or part without penalty, other

than a 1.00% prepayment premium if the Borrowers enter into certain repricing transactions with respect to the Term

Loan within one year. The Term Loan is secured by the same collateral as the Revolving Facility on a pari passu

basis with the Revolving Facility, and is guaranteed by the same subsidiaries of the Company that guarantee the

Revolving Facility.

The Domestic Credit Agreement limits our ability to make restricted payments, including dividends and share

repurchases, subject to specified exceptions that are available if, in each case, no event of default under the credit

facility exists immediately before or after giving effect to the restricted payment. These include exceptions that

require that projected availability under the credit facility, as defined, is at least 15% and an exception that requires

that the restricted payment is funded from cash on hand and not from borrowings under the credit facility. The

Domestic Credit Agreement also imposes various other requirements, which take effect if availability falls below

designated thresholds, including a cash dominion requirement and a requirement that the fixed charge ratio at the

last day of any quarter be not less than 1.0 to 1.0.

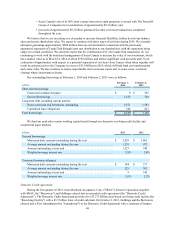

At February 1, 2014 and February 2, 2013, we had $1.3 billion and $749 million respectively, of Revolving

Facility borrowings and $661 million and $754 million, respectively, of letters of credit outstanding under the

Revolving Facility. The increase in Revolving Facility borrowings in 2013 is due to lower commercial paper

borrowings and increased domestic cash balances. At February 1, 2014, the amount available to borrow under the

Revolving Facility was $549 million, which reflects the effect of the springing fixed charge coverage ratio covenant

and the borrowing base limitation. At February 2, 2013, the amount available to borrow was $1.4 billion, which

reflects the effect of the springing fixed charge coverage ratio covenant, while the borrowing base requirement had

no effect on availability. The majority of the letters of credit outstanding are used to provide collateral for our

insurance programs. At February 1, 2014, we had $1.0 billion of borrowings under the Term Loan.

Senior Secured Notes

In October 2010, we sold $1 billion aggregate principal amount of senior secured notes (the “Notes”), which

bear interest at 6 5/8% per annum and mature on October 15, 2018. Concurrent with the closing of the sale of the

Notes, the Company sold $250 million aggregate principal amount of Notes to the Company’s domestic pension

plan in a private placement. The Notes are guaranteed by certain subsidiaries of the Company and are secured by a

security interest in certain assets consisting primarily of domestic inventory and credit card receivables (the

“Collateral”). The lien that secures the Notes is junior in priority to the lien on such assets that secures obligations

under the Domestic Credit Agreement, as well as certain other first priority lien obligations. The Company used the