Sears 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.43

2013 Compared to 2012

Revenues and Comparable Store Sales

Sears Canada’s revenues decreased $514 million for 2013 as compared to the same period last year and

included a $157 million decrease due to the impact of exchange rates during the year. On a Canadian dollar basis,

revenues decreased by $357 million. Revenues primarily decreased as a result of a new licensing arrangement

related to the SHIPS business, which accounted for approximately $150 million of the decline. Revenues also

decreased as a result of lower comparable store sales, which accounted for approximately $85 million of the decline,

and the closure of four Full-line stores, which accounted for approximately $70 million of the decline. Comparable

store sales declined 2.7%, which was primarily driven by declines in home furnishings, fitness, home decor,

electronics, home appliances and apparel and accessories. Fiscal 2012 also benefited from revenues of

approximately $35 million due to the 53rd week.

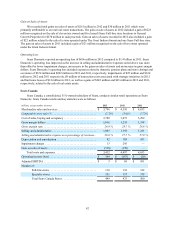

Gross Margin

Gross margin dollars decreased $219 million in 2013 to $1.0 billion and included a $42 million decrease due to

the impact of exchange rates. Gross margin decreased $177 million on a Canadian dollar basis, and included charges

of $1 million for markdowns recorded in connection with store closings announced during 2013. Sears Canada’s

gross margin rate decreased 190 basis points to 26.8%, in 2013 from 28.7% in 2012, due to an increase in inventory

reserve requirements.

Selling and Administrative Expenses

For 2013, Sears Canada’s selling and administrative expenses decreased $107 million, and included a decrease

of $45 million due to the impact of exchange rates. On a Canadian dollar basis, selling and administrative expenses

decreased by $62 million primarily due to decreases in advertising and payroll expenses. Selling and administrative

expenses for 2013 included expenses of $71 million related to store closings and severance. Selling and

administrative expenses for 2012 included expenses of $20 million related to store closings and severance, $3

million related to pension settlements and $3 million of transaction costs associated with strategic initiatives.

Sears Canada’s selling and administrative expense rate was 28.6% in 2013 and 27.7% in 2012 and increased

primarily due to decreased leverage as a result of the above noted decline in revenues.

Impairment Charges

We recorded impairment charges of $13 million in 2013 related to long-lived assets and $295 million in 2012

related to goodwill. Impairment charges recorded are further described in Notes12 and 13 of Notes to Consolidated

Financial Statements.

Gain on Sales of Assets

We recorded total gains on sales of assets of $538 million in 2013 and $170 million in 2012. During 2013, we

recorded gains on sales of assets of $357 million recognized on the surrender and early termination of the leases of

five properties operated by Sears Canada, for which Sears Canada received $381 million ($400 million Canadian) in

cash proceeds, and $180 million recognized on the amendment and early termination of the leases on two properties

operated by Sears Canada for which Sears Canada received $184 million ($191 million Canadian) in cash proceeds.

During 2012, we recorded a gain of $163 million recognized on the surrender and early termination of the

leases on three properties under an agreement with The Cadillac Fairview Corporation Limited for which Sears

Canada received $171 million ($170 million Canadian) in cash proceeds.