Sears 2013 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2013 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

90

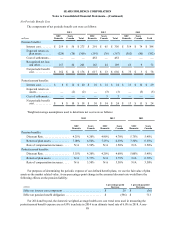

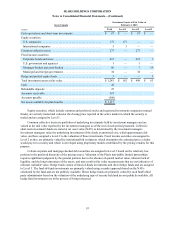

Future Cash Flows of Benefit Plans

Information regarding expected future cash flows for our benefit plans is as follows:

millions SHC

Domestic Sears

Canada Total

Pension benefits:

Employer contributions:

2014 (expected) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 487 $ — $ 487

Expected benefit payments:

2014. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 339 $ 79 $ 418

2015. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 342 80 422

2016. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 344 80 424

2017. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 344 80 424

2018. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 345 80 425

2019-2023 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,709 395 2,104

Postretirement benefits:

Employer contributions:

2014 (expected) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 25 $ 1 $ 26

Expected employer contribution for benefit payments:

2014. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 25 $ 16 $ 41

2015. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24 16 40

2016. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23 15 38

2017. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 15 36

2018. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 15 35

2019-2023 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80 71 151

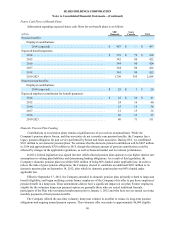

Domestic Pension Plan Funding

Contributions to our pension plans remain a significant use of our cash on an annual basis. While the

Company's pension plan is frozen, and thus associates do not currently earn pension benefits, the Company has a

legacy pension obligation for past service performed by Kmart and Sears associates. During 2013, we contributed

$361 million to our domestic pension plans. We estimate that the domestic pension contribution will be $487 million

in 2014 and approximately $310 million in 2015, though the ultimate amount of pension contributions could be

affected by changes in the applicable regulations, as well as financial market and investment performance.

In 2012, federal legislation was signed into law which allowed pension plan sponsors to use higher interest rate

assumptions in valuing plan liabilities and determining funding obligations. As a result of this legislation, the

Company's domestic pension plan was within $203 million of being 80% funded under applicable law. In order to

reduce the risks of gross pension obligations, the Company elected to contribute an additional $203 million to its

domestic pension plan on September 14, 2012, after which its domestic pension plan was 80% funded under

applicable law.

Effective September 17, 2012, the Company amended its domestic pension plan, primarily related to lump sum

benefit eligibility, and began notifying certain former employees of the Company of its offer to pay those employees'

pension benefit in a lump sum. These amendments did not have a significant impact on our plan. Former employees

eligible for the voluntary lump sum payment option are generally those who are vested traditional formula

participants of the Plan who terminated employment prior to January 1, 2012 and who have not yet started receiving

monthly payments of their pension benefits.

The Company offered the one-time voluntary lump sum window in an effort to reduce its long-term pension

obligations and ongoing annual pension expense. This voluntary offer was made to approximately 86,000 eligible