Sara Lee 2011 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As of July 2, 2011, the accrued liabilities remaining in the

Consolidated Balance Sheet related to these completed actions

total $14 million and represent certain severance obligations.

These accrued amounts are expected to be satisfied in cash and

will be funded from operations.

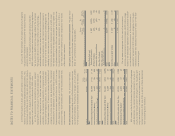

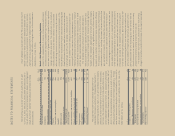

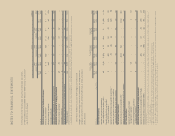

Note 7 – Common Stock

Changes in outstanding shares of common stock for the past three

years were:

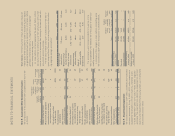

Shares in thousands 2011 2010 2009

Beginning balances 662,118 695,658 706,359

Stock issuances

Stock option and benefit plans 3,211 1,055 38

Restricted stock plans 1,992 1,741 543

Reacquired shares (80,221) (36,417) (11,390)

Other – 81 108

Ending balances 587,100 662,118 695,658

Common stock dividends and dividend-per-share amounts

declared on outstanding shares of common stock were:

In millions except per share data 2011 2010 2009

Common stock dividends declared $«275 $«299 $«306

Dividends per share amount declared $0.46 $0.44 $0.44

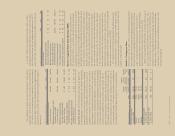

During 2010, the corporation’s Board of Directors had authorized

a $3.0 billion share repurchase program. In March of 2010, the

corporation repurchased 36.4 million shares at a cost of $500 mil-

lion under this program using an accelerated share repurchase

program (ASR). The ASR provides for a final settlement adjustment

at termination in either shares of common stock or cash based on

the final volume weighted average stock price. In 2011, the corpo-

ration paid $13 million as a final settlement on the ASR. During

2011, the corporation also repurchased 80.2 million shares at

a cost of $1.3 billion.

As of July 2, 2011, the remaining amount authorized for

repurchase is $1.2 billion of common stock under an existing share

repurchase program, plus 13.5 million shares of common stock

that remain authorized for repurchase under the corporation’s prior

share repurchase program. However, the corporation does not

expect to continue with any further share repurchases.

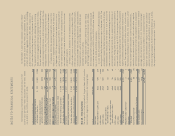

• Recognized costs related to the implementation of common

information systems across the organization in order to improve

operational efficiencies. These costs primarily relate to the amor-

tization of certain capitalized software costs.

• Recognized costs associated with the transition of business

support services to an outside third party vendor as part of a

business process outsourcing initiative.

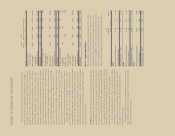

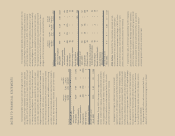

The following table summarizes the net charges taken for the exit,

disposal and transformation/Project Accelerate activities approved

during 2009 and the related status as of July 2, 2011. The accrued

amounts remaining represent those cash expenditures necessary to

satisfy remaining obligations. The majority of the cash payments to

satisfy the accrued costs are expected to be paid in the next year.

The corporation does not anticipate any additional material future

charges related to the 2009 actions. The composition of these

charges and the remaining accruals are summarized below.

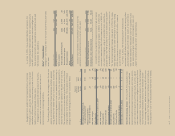

Employee

Termination IT and

and Other Other

In millions Benefits Costs Total

Exit, disposal and other costs

recognized during 2009 $101 $«19 $120

Charges recognized in

discontinued operations 13 3 16

Non-cash charges – (2) (2)

Cash payments (23) (14) (37)

Accrued costs as of June 27, 2009 91 6 97

Non-cash charges (3) – (3)

Cash payments (53) (2) (55)

Change in estimate (11) (1) (12)

Foreign exchange impacts (2) – (2)

Accrued costs as of July 3, 2010 22 3 25

Cash payments (10) – (10)

Change in estimate (6) – (6)

Foreign exchange impacts 1–1

Accrued costs as of July 2, 2011 $÷÷7 $÷«3 $÷10

Other Restructuring Actions Prior to 2009, the corporation had

approved and completed various actions to exit certain defined

business activities and lower its cost structure, and these actions

have had minimal impact on current year results. In 2011, adjust-

ments were made to certain accrued obligations remaining for these

completed actions. These adjustments related to the final settlement

of certain planned termination actions which decreased income

from continuing operations before income taxes by $2 million and

are reported in the “Net charges for exit activities, asset and busi-

ness dispositions” line of the Consolidated Statements of Income.

96/97 Sara Lee Corporation and Subsidiaries