Sara Lee 2011 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

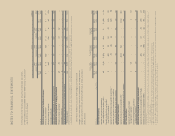

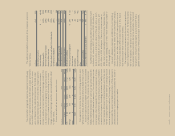

NOTES TO FINANCIAL STATEMENTS

Note 18 – Income Taxes

The provisions for income taxes on continuing operations computed

by applying the U.S. statutory rate to income from continuing opera-

tions before taxes as reconciled to the actual provisions were:

2011 2010 2009

Income (loss) from continuing

operations before income taxes

United States 7.6 % 1.4 % (98.9) %

Foreign 92.4 98.6 198.9

100.0 % 100.0 % 100.0 %

Tax expense (benefit) at

U.S. statutory rate 35.0 % 35.0 % 35.0 %

Tax on remittance of foreign earnings 6.0 22.0 14.6

Finalization of tax reviews and audits and

changes in estimate on tax contingencies (4.0) (25.1) (7.1)

Foreign taxes different than

U.S. statutory rate (12.8) (8.4) (19.1)

Valuation allowances 8.9 (0.6) 2.9

Benefit of foreign tax credits – – (5.4))

Contingent sale proceeds – (6.6) (17.7)

Tax rate changes – – (0.3)

Goodwill impairment – – 28.4

Tax provision adjustments (1.7) 2.6 2.9

Other, net (0.7) (1.3) 4.2

Taxes at effective worldwide tax rates 30.7 % 17.6 % 38.4 %

The tax expense related to continuing operations increased

$25 million in 2011 despite a $219 million decline in pretax income

from continuing operations. The increase in tax expense in 2011

was due to the year-over-year impact of a net tax benefit reported

in 2010 that included a $177 million tax benefit for the release of

certain contingent tax obligations after statutes in multiple jurisdic-

tions lapsed and certain tax regulatory examinations and reviews

were resolved, and a $47 million tax benefit related to the contin-

gent sales proceeds partially offset by a tax charge of $121 million

related to the corporation’s decision to no longer reinvest overseas

earnings primarily attributable to existing overseas cash and the

book value of the household and body care businesses.

The tax expense related to continuing operations was $9 million

higher in 2010 than in 2009 primarily due to a $408 million increase

in income from continuing operations before income taxes and a

tax charge of $121 million related to the corporation’s decision

to no longer reinvest overseas earnings primarily attributable to

existing overseas cash and the book value of the household and

body care businesses. Partially offsetting this was a benefit of

$177 million for the release of certain contingent tax obligations

as discussed above.

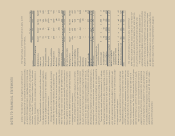

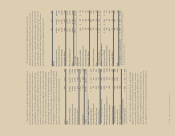

The funded status of postretirement health-care and life-insurance

plans related to continuing operations at the respective year-ends were:

In millions 2011 2010

Accumulated postretirement benefit obligation

Beginning of year $«104 $÷«89

Service cost 21

Interest cost 56

Net benefits paid (9) (12)

Plan participant contributions 21

Actuarial (gain) loss (12) 13

Plan amendments –7

Foreign exchange 1 (1)

End of year 93 104

Fair value of plan assets 1–

Funded status $÷(92) $(104)

Amounts recognized on the

consolidated balance sheets

Accrued liabilities $÷÷(7) $÷÷(9)

Other liabilities (85) (95)

Total liability recognized $÷(92) $(104)

Amounts recognized in accumulated

other comprehensive loss

Unamortized prior service credit $(137) $(157)

Unamortized net actuarial loss 26 51

Unamortized net initial asset (3) (5)

Total $(114) $(111)

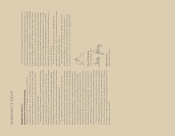

A significant portion of the unamortized prior service credits

relates to the North American fresh bakery operations. As such,

at the time of the completion of the sale of this business, which

is expected to be in the first quarter of 2012, these unamortized

prior service credits will be recognized as part of the gain/loss

on disposition of this business.

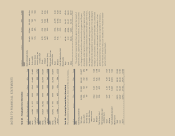

Expected Benefit Payments and Funding Substantially all

postretirement health-care and life-insurance benefit payments are

made by the corporation. Using foreign exchange rates at July 2,

2011 and expected future service, it is anticipated that the future

benefit payments that will be funded by the corporation will be as

follows: $8 million in 2012, 2013, 2014, 2015, and 2016 and

$43 million from 2017 to 2021.

The Medicare Part D subsidy received by the corporation

was $2 million in 2010. The subsidy received in 2011 and 2009

was not material.