Sara Lee 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

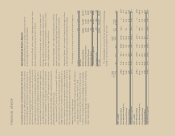

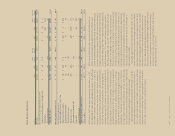

FINANCIAL REVIEW

Cash and Equivalents, Short-Term Investments and Cash Flow

The majority of the corporation’s cash balance of $2.066 billion at the

end of 2011 was invested in interest-bearing bank deposits that are

redeemable on demand by the corporation. A significant portion of

cash and equivalents are held by the corporation’s subsidiaries out-

side of the U.S. A portion of these balances will be used to fund

future working capital and other funding requirements.

The corporation has also recognized amounts for Project Accelerate

and other restructuring charges and at the end of 2011 recognized

a liability of approximately $200 million that relates primarily to

future severance and other lease and contractual payments. These

amounts will be paid when the obligation becomes due, and the

corporation expects a significant portion of these amounts will be

paid in 2012. The anticipated 2012 payments of cash taxes and

severance associated with previously recognized exit activities will

have a significant negative impact on cash from operating activities.

Dividend The corporation’s annualized dividend amounts per share

were $0.46 in 2011 and $0.44 in 2010 and 2009. As previously

noted, the board of directors intends to declare a $3.00 per share

dividend on the corporation’s common stock, the majority of which

will be funded from proceeds from the sale of the North American

Fresh Bakery business. This special dividend is expected to be

declared and paid in fiscal 2012 before the completion of the spin-

off. Future dividends are determined by the corporation’s Board of

Directors and are not guaranteed.

Credit Facilities and Ratings In June 2011, the corporation

amended its $1.85 billion five-year revolving credit facility that was

set to expire in December 2011. The amendment lowered the dollar

amount of the facility to $1.2 billion and extended the maturity date

to the earlier of June 4, 2013 or the date on which the spin-off of the

international beverage business is consummated. The credit facility

has an annual fee of 0.05% as of July 2, 2011 and pricing under this

facility is based on the corporation’s current credit rating. At July 2,

2011, the corporation did not have any borrowings outstanding under

this facility but it did have approximately $150 million of letters of

credit outstanding under this credit facility, of which $100 million

relates to the North American fresh bakery operations. The facility

does not mature or terminate upon a credit rating downgrade.

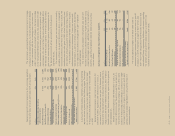

The corporation’s debt agreements and credit facility contain

customary representations, warranties and events of default, as

well as, affirmative, negative and financial covenants with which

the corporation is in compliance. One financial covenant includes a

requirement to maintain an interest coverage ratio of not less than

2.0 to 1.0. The interest coverage ratio is based on the ratio of EBIT

to consolidated net interest expense with consolidated EBIT equal

to net income plus interest expense, income tax expense, and

extraordinary or non-recurring non-cash charges and gains. For the

12 months ended July 2, 2011, the corporation’s interest coverage

ratio was 7.0 to 1.0.

In addition to regular contributions, the corporation could be

obligated to pay additional contributions (known as a complete or

partial withdrawal liability) if a MEPP has unfunded vested benefits.

These withdrawal liabilities, which would be triggered if the corpora-

tion ceases to make contributions to a MEPP with respect to one

or more collective bargaining units, would equal the corporation’s

proportionate share of the unfunded vested benefits based on the

year in which liability is triggered. The corporation believes that

certain of the MEPPs in which it participates have unfunded vested

benefits, and some are significantly underfunded. Withdrawal liabil-

ity triggers could include the corporation’s decision to close a plant

or the dissolution of a collective bargaining unit. Due to uncertainty

regarding future withdrawal liability triggers, we are unable to deter-

mine the amount and timing of the corporation’s future withdrawal

liability, if any, or whether the corporation’s participation in these

MEPPs could have any material adverse impact on its financial

condition, results of operations or liquidity. Disagreements over

potential withdrawal liability may lead to legal disputes.

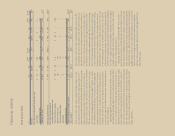

The corporation’s regular scheduled contributions to MEPPs

related to continuing operations totaled approximately $3 million

in 2011, $4 million in 2010, and $5 million in 2009. For continuing

operations, the corporation incurred withdrawal liabilities of an

immaterial amount in 2011, 2010 and 2009.

Repatriation of Foreign Earnings and Income Taxes The corporation

anticipates that it will continue to repatriate a portion of its foreign

subsidiary’s future earnings. The tax expense associated with any

return of foreign earnings will be recognized as such earnings are

realized. However, the corporation pays the liability upon completing

the repatriation action. The repatriation of foreign sourced earnings

is not the only source of liquidity for the corporation. In addition to

cash flow derived from operations, the corporation has access to

the commercial paper market, a $1.2 billion revolving credit facility,

and access to public and private debt markets as a means to gen-

erate liquidity sufficient to meet its U.S. cash flow needs.

In 2011, the continuing operations tax expense for repatriating

a portion of 2011 and prior year earnings to the U.S. is $14 million,

with the majority of these taxes paid during 2011. In addition, the

corporation has recognized $180 million of tax expense in discon-

tinued operations related to the repatriation of the gain on the sale

of the household and body care businesses of which $190 million

was recognized in gains on sales and a credit of $10 million was

recognized in discontinued operating results. It is anticipated that

a majority of the cash taxes related to this repatriation action will

be paid after calendar 2011. The deferred tax liability at the end

of 2011 is $769 million and relates primarily to repatriation taxes

recognized in 2010 and 2011.