Sara Lee 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL REVIEW

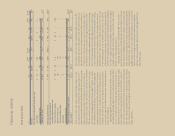

• Cash from operating activities was $447 million in 2011, a

decrease of $505 million due to the decline in operating results,

the impact of business dispositions and increased working capital

usage partially offset by lower cash payments for pensions.

• Under the corporation’s capital plan, the company expended

$1.3 billion to repurchase 80.2 million shares of its common stock.

Significant Items Affecting Comparability The reported results for

2011, 2010 and 2009 reflect amounts recognized for restructuring

actions and other significant amounts that impact comparability.

“Significant items” are income or charges (and related tax impact)

that management believes have had or are likely to have a significant

impact on the earnings of the applicable business segment or on

the total corporation for the period in which the item is recognized,

are not indicative of the company’s core operating results and

affect the comparability of underlying results from period to period.

Significant items may include, but are not limited to: charges for

exit activities; transformation program and Project Accelerate costs;

spin-off related costs; impairment charges; pension partial with-

drawal liability charges; benefit plan curtailment gains and losses;

tax charges on deemed repatriated earnings; tax costs and benefits

resulting from the disposition of a business; impact of tax law

changes; changes in tax valuation allowances and favorable or unfa-

vorable resolution of open tax matters based on the finalization of

tax authority examinations or the expiration of statutes of limitations.

The impact of the above items on net income and diluted earnings

per share is summarized on the following page.

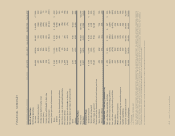

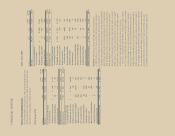

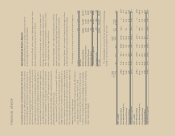

Impact of significant items on income from continuing

operations before income taxes:

In millions 2011 2010 2009

Pretax Impact

Cost of sales $÷÷(2) $÷«÷– $÷÷«6

Selling, general and admin expenses (58) (40) 11

Exit and business dispositions (105) (84) (98)

Impairment charges (21) (28) (314)

Debt extinguishment costs (55) – –

Total $(241) $(152) $(395)

Management also uses certain of these non-GAAP financial

measures, in conjunction with the GAAP financial measures, to

understand, manage and evaluate our businesses, in planning for

and forecasting financial results for future periods, and as one fac-

tor in determining achievement of incentive compensation. Two of

the three performance measures under Sara Lee’s annual incentive

plan are net sales and operating income, which are the reported

amounts as adjusted for significant items and possibly other items.

Operating income, as adjusted for significant items, also may be used

as a component of Sara Lee’s long-term incentive plans. Many of the

significant items will recur in future periods; however, the amount and

frequency of each significant item varies from period to period. See

Non-GAAP Measures Definitions

in the Financial Review section of this

report for additional information regarding these financial measures.

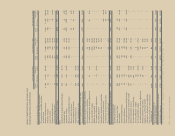

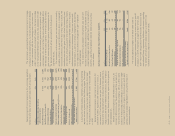

Summary of Results

The business highlights for 2011 include the following:

• Net sales for the year were $8.7 billion, an increase of

$342 million, or 4.1% over the prior year, as pricing actions in

response to higher commodity costs, the impact of recent acquisi-

tions and changes in foreign currency exchange rates offset the

negative impact of lower unit volumes and the 53rd week in the

prior year. Adjusted net sales increased 4.9 %.

• Reported operating income for the year was $627 million, a

decrease of $194 million, which resulted from the cessation of con-

tingent sales proceeds, lower operating results for the International

Beverage business segment primarily driven by raw material costs

increases and the unfavorable impact of the 53rd week in the prior

year. Adjusted operating income decreased $18 million, or 2.0%.

• Operating segment income was negatively impacted by the

year-over-year increase in commodity costs net of pricing actions

and lower unit volumes. These declines were partially offset by cost

savings achieved from Project Accelerate and continuous improve-

ment initiatives and a 5% decline in spending on media advertising

and promotions (MAP).

• Net income from continuing operations attributable to Sara Lee

was $338 million, or $0.54 per share on a diluted basis, a decline

of $244 million. The year-over-year decline reflects the lower results

for the business segments, the cessation of contingent sale pro-

ceeds, $55 million of debt extinguishment costs and an increase

in income tax expense. Net income attributable to Sara Lee was

$1.287 billion or $2.06 per share on a diluted basis, which includes

a $736 million after tax gain on the sale of businesses.