Sara Lee 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

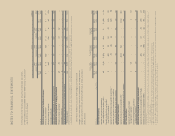

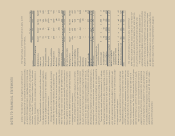

NOTES TO FINANCIAL STATEMENTS

In millions Quarter First Second Third Fourth

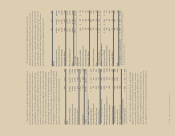

2010

Continuing operations

Net sales $1,969 $2,262 $1,995 $2,113

Gross profit 687 835 752 709

Income (loss) 176 285 13 108

Income (loss) per

common share

Basic 0.25 0.41 0.02 0.16

Diluted 0.25 0.41 0.02 0.16

Net income (loss) 287 376 (328) 192

Net income (loss) per

common share

Basic 0.41 0.53 (0.49) 0.28

Diluted 0.41 0.53 (0.49) 0.28

Cash dividends declared – 0.11 0.11 0.22

Market price

High 11.36 12.61 14.17 15.08

Low 9.17 10.64 11.67 12.83

Close 11.21 12.45 13.74 13.99

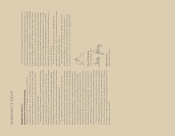

The quarterly financial data shown above includes the impact of

significant items. Significant items may include, but are not limited

to: charges for exit activities; transformation program and Project

Accelerate costs; spin-off costs; impairment charges; pension partial

withdrawal liability charges; benefit plan curtailment gains and losses;

tax charges on deemed repatriated earnings; tax costs and benefits

resulting from the disposition of a business; impact of tax law changes;

changes in tax valuation allowances and favorable or unfavorable

resolution of open tax matters based on the finalization of tax

authority examinations or the expiration of statutes of limitations.

Further details of these items are included in the Financial Review

section of the Annual Report.

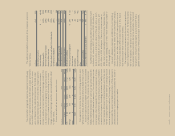

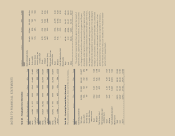

Note 20 – Geographic Area Information

In millions United States Netherlands Spain France Other Total

2011

Sales $4,383 $÷«977 $555 $562 $2,204 $8,681

Long-lived

assets 1,460 302 188 346 485 2,781

2010

Sales $4,315 $1,001 $607 $509 $1,907 $8,339

Long-lived

assets 1,447 274 180 294 363 2,558

2009

Sales $4,501 $÷«987 $649 $526 $1,703 $8,366

Long-lived

assets 1,482 345 244 316 386 2,773

Note 21 – Quarterly Financial Data (Unaudited)

The corporation’s quarterly results for 2011 and 2010 are as follows:

In millions Quarter First Second Third Fourth

2011

Continuing operations

Net sales $1,988 $2,254 $2,142 $2,297

Gross profit 646 763 710 694

Income (loss) 64 96 130 48

Income (loss) per

common share

Basic 0.10 0.15 0.21 0.08

Diluted 0.10 0.15 0.21 0.08

Net income (loss) 194 833 156 113

Net income (loss) per

common share

Basic 0.29 1.30 0.25 0.19

Diluted 0.29 1.30 0.25 0.19

Cash dividends declared – 0.115 0.115 0.23

Market price

High 15.40 17.72 20.26 19.80

Low 13.22 14.00 16.45 17.87

Close 13.43 17.51 17.90 19.32