Sara Lee 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56/57 Sara Lee Corporation and Subsidiaries

of $361 million over the prior year due to the impact of income

taxes. In 2011, the North American fresh bakery business reported

a $101 million income tax benefit, which included a $122 million

tax benefit that was associated with the excess tax basis related to

these assets. In 2010, the international household and body care

businesses reported $453 million of income tax expense, which

included a $428 million tax charge related to the deemed repatriation

of overseas earnings, attributable to the existing overseas cash and

book value of the International Household and Body Care businesses.

Net sales for discontinued operations were $4.580 billion in

2010, an increase of $64 million, or 1.4% over the prior year. The

sales growth was primarily driven by strength in the insecticides,

shoe care and body care core categories, as well as the additional

53rd week and favorable foreign currency exchange rates, partially

offset by a decline in North American fresh bakery sales. Pretax

income in 2010 was $342 million, an increase of $37 million or

12% compared to 2009. The increase pretax income was driven

by improved results for the household and body care operations,

which were benefited by $33 million due to the cessation of depre-

ciation and amortization in accordance with the accounting rules

for assets held for sale and improved results for the North American

fresh bakery and refrigerated dough businesses. Discontinued

operations reported a loss of $139 million in fiscal 2010, due to

$481 million of income tax expense. The increase in tax expense

was related to the deemed repatriation of overseas earnings,

attributable to the existing overseas cash and book value of the

International Household and Body Care businesses.

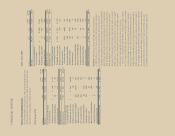

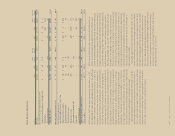

Gain (Loss) on Sale of Discontinued Operations

In 2011, the

corporation completed the disposition of the majority of the busi-

nesses that comprised the household and body care business –

global body care, European detergents, and Australia/New Zealand

bleach businesses as well as a majority of the air care and shoe

care businesses and recognized a pretax gain of $1.3 billion and an

after tax gain of $736 million. In 2010, the corporation completed

the disposition of its insecticide business in India, which had been

part of the household and body care business, and recognized a

pretax gain of $150 million and an after tax gain of $78 million.

Further details regarding these transactions are included in Note 5

to the Consolidated Financial Statements, “Discontinued Operations.”

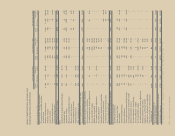

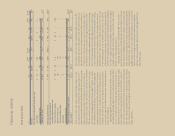

Diluted EPS from continuing operations was $0.54 in 2011,

$0.84 in 2010 and $0.26 in 2009. The diluted EPS from continuing

operations in each succeeding year was favorably impacted by lower

average shares outstanding as the corporation has been repurchasing

shares of its common stock as part of an ongoing share repurchase

program. The corporation repurchased 80.2 million shares in 2011,

36.4 million shares in 2010 and 11.4 million shares in 2009.

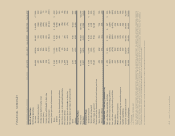

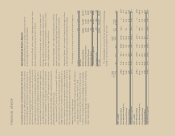

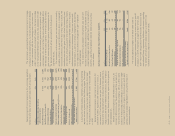

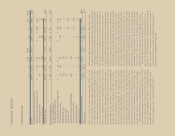

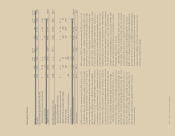

Discontinued Operations The results of the corporation’s North

American fresh bakery and refrigerated dough businesses and the

household and body care businesses, which have been classified

as discontinued operations, are summarized below:

In millions 2011 2010 2009

Net sales $3,422 $4,580 $4,516

Income from discontinued

operations before income taxes $÷«172 $÷«342 $÷«305

Income tax (expense) on income

from discontinued operations 50 (481) (109)

Gain (loss) on disposition of

discontinued operations

before income taxes 1,304 158 –

Income tax (expense) benefit on

disposition of discontinued operations (568) (74) –

Net income (loss) from

discontinued operations $÷«958 $÷÷(55) $÷«196

Income (Loss) from Discontinued Operations before Income Taxes

Net sales for discontinued operations were $3.422 billion in 2011,

compared to $4.580 billion in the prior year, a 25.3% decrease.

The sales decline was primarily driven by the impact of business

dispositions after the start of 2010, which reduced net sales by

$1.1 billion as well as the impact of the additional 53rd week in

the prior year. Income before income taxes in 2011 was $172 mil-

lion, a decrease of $170 million compared to 2010. The decrease

was again driven by the impact of business dispositions, the addi-

tional 53rd week and various other restructuring and other charges

which reduced operating income by $191 million. Income from dis-

continued operations was $222 million in fiscal 2011, an increase