Sara Lee 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

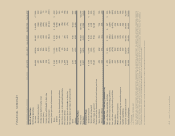

52/53 Sara Lee Corporation and Subsidiaries

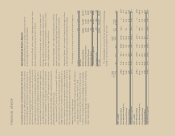

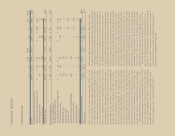

Volume Impact

(Excl. 53rd of 53rd Acq./ Foreign

Week) Mix Price Other Week Disp. Exchange Total

2011 versus 2010 (4.7) % 2.5% 5.6 % 1.5 % (1.7) % 0.5 % 0.4% 4.1 %

2010 versus 2009 (3.9) % 3.0% (1.0) % (0.3) % 1.7 % (1.6) % 1.8% (0.3) %

The following table summarizes the components of the

change in sales on a percentage basis versus the prior year:

Net Sales Bridge – Components of Change vs Prior Year

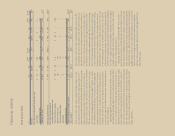

Operating Income Operating income decreased by $194 million,

or 23.6% in 2011. The year-over-year net impact of the change in

contingent sales proceeds, currency rates, transformation/Project

Accelerate charges, impairment charges, and the other factors

identified in the preceding table decreased operating income by

$176 million. As a result, adjusted operating income decreased

$18 million, or 2.0% due to the decline in adjusted operating results

for the business segments, primarily International Beverage, partially

offset by the favorable impact of a $24 million improvement in

unrealized commodity mark-to-market derivatives and a significant

decline in general corporate expenses.

Operating income increased by $403 million, or 96.4% in 2010.

The year-over-year net impact of the changes in currency rates,

Project Accelerate/transformation charges, impairment charges and

the other factors identified in the preceding table increased operat-

ing income by $251 million. Adjusted operating income increased

$152 million, or 22.4% due to lower commodity costs, the benefits

of cost saving initiatives, and an improved sales mix partially offset

by lower unit volumes and higher MAP spending.

The changes in the individual components of operating income

are discussed in more detail below.

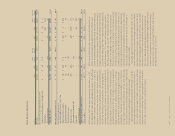

Gross Margin The gross margin, which represents net sales less

cost of sales, decreased by $170 million in 2011, driven by the

negative impact of higher commodity costs net of pricing actions,

lower unit volumes and the impact of the 53rd week, partially offset

by the benefits of cost saving initiatives and an improved sales mix.

The gross margin percent decreased from 35.8% in 2010 to

32.4% in 2011 due to gross margin percent declines for all business

segments but primarily at International Beverage. The gross margin

percent was negatively impacted by higher commodity costs which

were partially offset by pricing actions, a favorable shift in product

mix and continuous improvement savings.

The gross margin increased by $231 million in 2010 compared to

2009, driven by lower commodity costs, the benefits of cost saving

initiatives, the favorable impact of changes in currency exchange rates,

an improved sales mix and the impact of the 53rd week, partially

offset by the impact of lower unit volumes and lower prices.

The gross margin percent increased from 32.9% in 2009 to

35.8% in 2010 due to gross margin percent improvements for all

business segments but primarily at North American Retail and

International Beverage. The gross margin percent was positively

impacted by lower commodity costs, a favorable shift in product mix

and continuous improvement savings, which were partially offset by

pricing actions and the negative impact of inflation on labor and

other employee benefit costs.

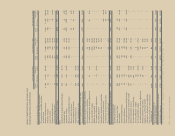

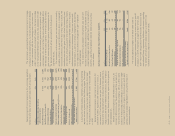

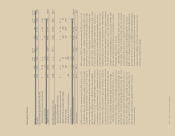

Selling, General and Administrative Expenses

In millions 2011 2010 2009

SG&A expenses in the business

segment results

Media advertising and promotion $÷«323 $÷«340 $÷«279

Other 1,561 1,571 1,552

Total business segments 1,884 1,911 1,831

Amortization of identifiable intangibles 22 21 21

General corporate expenses 155 246 213

Mark-to-market derivative

(gains)/losses (1)57

Total SG&A $2,060 $2,183 $2,072

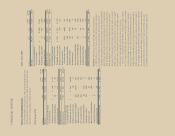

Total selling, general and administrative (SG&A) expenses in

2011 decreased $123 million, or 5.6%. Changes in foreign currency

exchange rates, primarily in the European euro, decreased SG&A

expenses by $5 million, or 0.2%. The remaining decrease in SG&A

expenses was $118 million, or 5.4%. Measured as a percent of

sales, SG&A expenses decreased from 26.2% in 2010 to 23.7% in

2011. SG&A expenses as a percent of sales decreased in each of

the business segments, with the exception of International Bakery.

The results reflect the impact of lower MAP expenses and the

benefits of cost saving initiatives.