Sara Lee 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76/77 Sara Lee Corporation and Subsidiaries

statements. The amendments did not change the items that must

be reported in other comprehensive income or when an item of

other comprehensive income must be reclassified to net income.

The amendment is retroactively effective for the corporation begin-

ning in the first quarter of fiscal 2013. This standard will not have

an impact on our consolidated results of operations, financial

position or cash flows.

Fair Value Measurement and Disclosure

In May 2011, the FASB

issued an update amending the accounting standards for fair value

measurement and disclosure, resulting in common principles and

requirements under U.S. generally accepted accounting principles

(“US GAAP”) and International Financial Reporting Standards

(“IFRS”). The amendments change the wording used to describe

certain of the US GAAP requirements either to clarify the intent of

existing requirements, to change measurement or expand disclo-

sure principles or to conform to the wording used in IFRS. The

amendments are to be applied prospectively and will be effective

beginning with the second quarter of 2012 for the corporation.

Early application is not permitted. We do not expect adoption of

these amendments to have a significant impact on our consoli-

dated results of operations, financial position or cash flows.

Forward-Looking Information

This document contains certain forward-looking statements, including

the anticipated costs and benefits of restructuring, transformation

and Project Accelerate actions, access to credit markets and the

corporation’s credit ratings, the planned extinguishment of debt, the

funding of pension plans, potential payments under guarantees and

amounts due under future contractual obligations and commitments,

projected capital expenditures, cash tax payments, pension settlement

amounts and effective tax rates. In addition, from time to time, in

oral statements and written reports, the corporation discusses its

expectations regarding the corporation’s future performance by making

forward-looking statements preceded by terms such as “expects,”

“projects,” “anticipates” or “believes.” These forward-looking state-

ments are based on currently available competitive, financial and

economic data, as well as management’s views and assumptions

regarding future events. Such forward-looking statements are inher-

ently uncertain, and investors must recognize that actual results

may differ from those expressed or implied in the forward-looking

statements. Consequently, the corporation wishes to caution read-

ers not to place undue reliance on any forward-looking statements.

Among the factors that could cause Sara Lee’s actual results to

differ from such forward-looking statements are those described

under Item 1A, Risk Factors, in Sara Lee’s most recent Annual Report

on Form 10-K and other SEC Filings, as well as factors relating to:

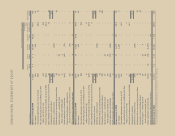

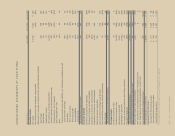

The following information illustrates the sensitivity of the net

periodic benefit cost and projected benefit obligation to a change

in the discount rate and return on plan assets. Amounts relating to

foreign plans are translated at the spot rate at the close of 2011.

The sensitivities reflect the impact of changing one assumption at

a time and are specific to base conditions at the end of 2011 and

treat the North American fresh bakery and household and body care

businesses as discontinued operations. It should be noted that

economic factors and conditions often affect multiple assumptions

simultaneously and that the effects of changes in assumptions are

not necessarily linear.

Increase/(Decrease) in

2011

2012 Projected

Net Periodic Benefit

Assumption Change Benefit Cost Obligation

Discount rate 1% increase $(10) $(547)

1% decrease 31 624

Asset return 1% increase (45) –

1% decrease 45 –

The corporation’s defined benefit pension plans had a net

unamortized actuarial loss of $715 million in 2011 and $1.032 bil-

lion in 2010. The unamortized actuarial loss is reported in the

“Accumulated other comprehensive loss” line of the Consolidated

Balance Sheet. The decrease in the net actuarial loss in 2011 was pri-

marily due to an increase in the weighted average discount rate and

actual asset performances in excess of the asset return assumptions.

As indicated above, changes in the bond yields, expected future

returns on assets, and other assumptions can have a material impact

upon the funded status and the net periodic benefit cost of defined

benefit pension plans. It is reasonably likely that changes in these

external factors will result in changes to the assumptions used

by the corporation to measure plan obligations and net periodic

benefit cost in future periods.

Issued but not yet Effective Accounting Standards

Following is a discussion of recently issued accounting standards

that the corporation will be required to adopt in a future period.

Comprehensive Income

The Financial Accounting Standards Board

(“FASB”) amended the reporting standards for comprehensive income

in June 2011 to eliminate the option to present the components of

other comprehensive income as part of the statement of changes

in stockholders’ equity. All non-owner changes in stockholders’ equity

are required to be presented either in a single continuous statement

of comprehensive income or in two separate but consecutive