Sara Lee 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

parties to the derivative instruments could request immediate

payment or demand immediate collateralization on the derivative

instruments in net liability positions. The aggregate fair value of all

derivative instruments with credit-risk-related contingent features

that are in a liability position was $272 million on July 2, 2011 and

$197 million on July 3, 2010, for which the corporation has posted

no collateral. If the credit-risk-related contingent features underlying

these agreements were triggered on July 2, 2011 and July 3, 2010,

the corporation would be required to post collateral of, at most,

$272 million and $197 million, respectively, with its counterparties.

A large number of major international financial institutions are

counterparties to the corporation’s financial instruments including

cross currency swaps, interest rate swaps, and currency exchange

forwards and swaps. The corporation enters into financial instru-

ment agreements only with counterparties meeting very stringent

credit standards (a credit rating of A-/A3 or better), limiting the

amount of agreements or contracts it enters into with any one party

and, where legally available, executing master netting agreements.

These positions are continually monitored. While the corporation

may be exposed to credit losses in the event of nonperformance by

individual counterparties of the entire group of counterparties, it

has not recognized any losses with these counterparties in the past

and does not anticipate material losses in the future.

Trade accounts receivable due from customers that the corporation

considers highly leveraged were $132 million at July 2, 2011 and

$103 million at July 3, 2010.

Fair Value Measurements Fair value is defined as the price that

would be received to sell an asset or paid to transfer a liability (i.e.,

exit price) in an orderly transaction between market participants at

the measurement date. Assets and liabilities measured at fair value

must be categorized into one of three different levels depending on

the assumptions (i.e., inputs) used in the valuation. Level 1 provides

the most reliable measure of fair value while level 3 generally requires

significant management judgment. Assets and liabilities are classi-

fied in their entirety based on the lowest level of input significant

to the fair value measurement.

The carrying amounts of cash and equivalents, trade accounts

receivables, accounts payable, derivative instruments and notes

payable approximate fair values. The fair value of the corporation’s

long-term debt, including the current portion, is estimated using dis-

counted cash flows based on the corporation’s current incremental

borrowing rates for similar types of borrowing arrangements.

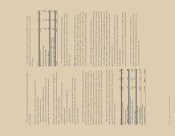

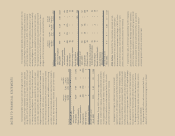

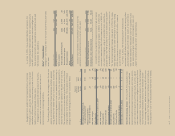

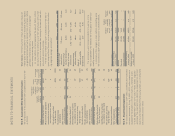

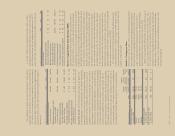

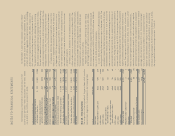

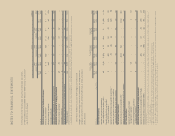

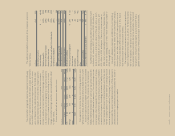

July 2, 2011 July 3, 2010

Fair Carrying Fair Carrying

In millions Value Amount Value Amount

Long-term debt, including

current portion $2,413 2,409 $2,777 2,629

Non-Derivative Instruments The corporation uses non-derivative

instruments such as non-U.S. dollar financing transactions or

non-U.S. dollar assets or liabilities, including intercompany loans,

to hedge the exposure of changes in underlying foreign currency

denominated subsidiary net assets, and they are declared as Net

Investment Hedges.

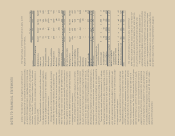

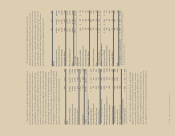

Volume

Hedge

Coverage

July 2, July 3, (Number of

In millions 2011 2010 Months)

Swap contracts

Rec. fixed/pay float –

interest rate swap notional $÷«584 $÷«761 8.9 – 23.5

Rec. fixed/pay fixed –

cross currency swaps notional1813 704 2.5 – 23.5

Forward rate agreement –50 –

Foreign currency forward contracts1

Commitments to purchase

foreign currencies $2,757 $4,211 0.1 – 11.6

Commitments to sell

foreign currencies 2,754 4,066 0.1 – 11.6

Foreign currency option contracts1, 2 $÷÷÷«– $÷÷÷«9 –

Commodity contracts

Commodity future contracts3$÷«193 $÷«143 2.0 – 11.0

Commodity options contracts277 3 0.1 – 5.0

Net Investment Hedges $4,052 $4,500 –

1 The notional value is calculated using the exchange rates as of reporting date.

2 Option contract notional values are determined by the ratio of the change in option

value to the change in the underlying hedged item.

3 Commodity futures contracts are determined by the initial cost of the contract.

Cash Flow Presentation The settlement of derivative contracts

related to the purchase of inventory, commodities or other hedged

items that utilize hedge accounting are reported in the Consolidated

Statements of Cash Flows as an operating cash flow, while those

derivatives that utilize the mark-to-market hedge accounting model

are reported in investing activities when those contracts are realized

in cash. Fixed to floating rate swaps are reported as a component of

interest expense and therefore are reported in cash flow from oper-

ating activities similar to how cash interest payments are reported.

The portion of the gain or loss on a cross currency swap that offsets

the change in the value of interest expense is recognized in cash

flow from operations.

Contingent Features/Concentration of Credit Risk All of the

corporation’s derivative instruments are governed by International

Swaps and Derivatives Association (i.e. ISDA) master agreements,

requiring the corporation to maintain an investment grade credit

rating from both Moody’s and Standard & Poor’s credit rating agen-

cies. If the corporation’s credit rating were to fall below investment

grade, it would be in violation of these provisions, and the counter-

104/105 Sara Lee Corporation and Subsidiaries