Sara Lee 2011 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO FINANCIAL STATEMENTS

Lease obligations associated with the VIE’s are secured by the

vehicles subject to lease and do not represent additional claims

on the corporation’s general assets. The corporation’s maximum

exposure for loss associated with the Independent Operator enti-

ties is limited to $50 million of long-term debt of the Independent

Operators as of July 2, 2011.

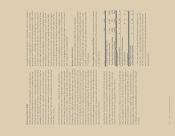

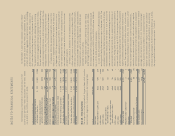

Note 6 – Exit, Disposal and Restructuring Activities

As part of its ongoing efforts to improve its operational performance

and reduce cost, the corporation initiated Project Accelerate in 2009,

which was a series of global initiatives designed to drive significant

savings over a three year period. The overall cost of the initiatives

includes severance costs as well as transition costs associated

with transferring services to an outside third party. An important

component of Project Accelerate involves outsourcing pieces of the

North American and European Finance (transaction processing) and

Global Information Services (applications development and mainte-

nance) groups as well as the company’s indirect procurement

activities. In addition to cost savings, this business process out-

sourcing will help the corporation drive standardization, increase

efficiency and provide flexibility. The implementation of the initiative

in North America and Europe began in the second quarter of 2009

and has been substantially completed as of the end of 2011.

The company had also announced a transformation plan in

February 2005 designed to improve performance and better posi-

tion the company for long-term growth. The plan involved significant

changes in the company’s organizational structure, portfolio changes

involving the disposition of a significant portion of the corporation’s

business, and a number of actions to improve operational efficiency.

The corporation has recognized certain trailing costs related to these

transformation actions, including the impact of certain activities that

were completed for amounts more favorable than previously estimated.

In January 2011, the corporation announced that its board of

directors had agreed in principle to divide the company into two sep-

arate, publicly traded companies which is expected to be completed

in the first half of calendar 2012. Under this plan, the corporation’s

International Beverage operations will be spun-off, tax-free, into a

new public company. As the corporation prepares for the spin-off,

it will incur certain spin-off related costs. Spin-off related costs will

include restructuring actions such as employee termination costs

and costs related to renegotiating contractual agreements; third

party professional fees for consulting and other services that are

directly related to the spin-off; and the costs of employees solely

dedicated to activities directly related to the spin-off.

The corporation also incurs exit, disposition and restructuring

charges for initiatives outside of the scope of the projects noted above.

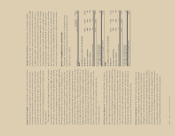

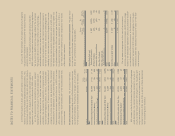

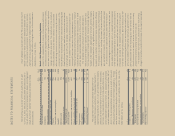

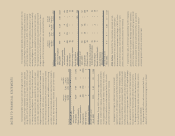

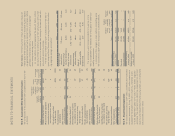

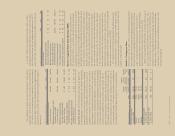

The following is a summary of the net assets held for sale

as of July 2, 2011 and July 3, 2010, which primarily consists of

the net assets of the North American fresh bakery and refrigerated

dough businesses and the international household and body

care businesses.

July 2, July 3,

In millions 2011 2010

Trade accounts receivable $÷«173 $÷«200

Inventories 84 240

Other current assets 28 51

Total current assets held for sale 285 491

Property 558 616

Trademarks and other intangibles 263 452

Goodwill 612 1,038

Deferred assets (91) –

Other noncurrent assets 49 17

Assets held for sale $1,676 $2,614

Accounts payable $134 $137

Accrued expenses and other current liabilities 157 303

Current maturities of long-term debt 16 20

Total current liabilities held for sale 307 460

Long-term debt 79 92

Other liabilities 194 320

Liabilities held for sale $÷«580 $÷«872

Noncontrolling interest $÷÷«29 $÷÷«28

The corporation enters into franchise agreements with

independent third party contractors (“Independent Operators”)

representing distribution rights to sell and distribute fresh bakery

products via direct-store-delivery to retail outlets in defined sales

territories. The corporation does not hold equity interests in any

of the Independent Operator entities. The corporation determined

that all Independent Operators are variable interest entities (VIE) of

which it is the primary beneficiary, primarily as a result of Sara Lee’s

debt guarantee and other route maintenance obligations. The bal-

ance sheet amounts resulting from the consolidation of these VIE’s,

which are included in the assets and liabilities held for sale in the

table above, are as follows:

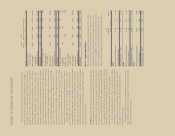

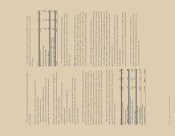

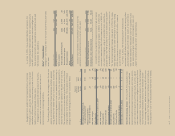

In millions 2011 2010

Inventories – Finished goods $÷2 $÷2

Property – Machinery and equipment 18 22

Total assets $20 $24

Current portion of long-term debt $13 $12

Long-term debt excluding current portion 49 58

Total liabilities $62 $70

Noncontrolling interests $28 $23