Sara Lee 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

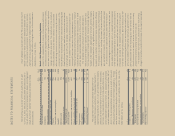

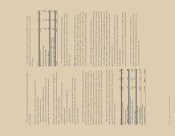

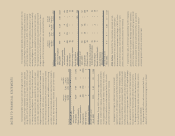

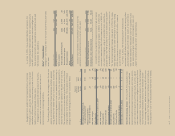

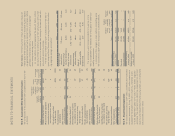

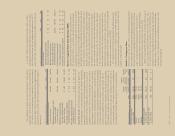

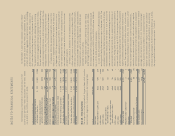

NOTES TO FINANCIAL STATEMENTS

Currency Forward Exchange, Futures and Option Contracts

The corporation uses forward exchange and option contracts to

reduce the effect of fluctuating foreign currencies on short-term

foreign-currency-denominated intercompany transactions, third-party

product-sourcing transactions, foreign-denominated investments

(including subsidiary net assets) and other known foreign currency

exposures. Gains and losses on the derivative instruments are

intended to offset losses and gains on the hedged transaction in

an effort to reduce the earnings volatility resulting from fluctuating

foreign currency exchange rates. Forward currency exchange con-

tracts which are effective at hedging the fair value of a recognized

asset or liability are designated and accounted for as fair value

hedges. Forward currency contracts that act as a hedge of changes

in the underlying foreign currency denominated subsidiary net assets

are accounted for as net investment hedges. All remaining currency

forward and options contracts are accounted for as mark-to-market

hedges. The principal currencies hedged by the corporation include

the European euro, British pound, Danish kroner, Hungarian forint,

U.S. dollar, Australian dollar and Brazilian real. The corporation

hedges virtually all foreign exchange risk derived from recorded

transactions and firm commitments and only hedges foreign

exchange risk related to anticipated transactions where the

exposure is potentially significant.

Commodity Futures and Options Contracts

The corporation uses

commodity futures and options to hedge a portion of its commodity

price risk. The principal commodities hedged by the corporation

include hogs, beef, natural gas, diesel fuel, coffee, corn, wheat and

other ingredients. The corporation does not use significant levels

of commodity financial instruments to hedge commodity prices

and primarily relies upon fixed rate supplier contracts to determine

commodity pricing. In circumstances where commodity-derivative

instruments are used, there is a high correlation between the com-

modity costs and the derivative instruments. For those instruments

where the commodity instrument and underlying hedged item corre-

late between 80-125%, the corporation accounts for those contracts

as cash flow hedges. However, the majority of commodity derivative

instruments are accounted for as mark-to-market hedges. The corpo-

ration only enters into futures and options contracts that are traded

on established, well-recognized exchanges that offer high liquidity,

transparent pricing, daily cash settlement and collateralization

through margin requirements.

Contingent Debt Obligations and Other

The corporation has

guaranteed the payment of certain third-party debt. The maximum

potential amount of future payments that the corporation could be

required to make, in the event that these third parties default on their

debt obligations, is $12 million. At the present time, the corpora-

tion does not believe it is probable that any of these third parties

will default on the amount subject to guarantee.

In 2010, the corporation recognized a $26 million charge for

a Mexican tax indemnification related to the corporation’s direct

selling business that was sold in 2006.

Note 15 – Financial Instruments

Background Information The corporation uses derivative financial

instruments, including forward exchange, futures, options and swap

contracts, to manage its exposures to foreign exchange, commodity

prices and interest rate risks. The use of these derivative financial

instruments modifies the exposure of these risks with the intent to

reduce the risk or cost to the corporation. The corporation does not

use derivatives for trading or speculative purposes and is not a party

to leveraged derivatives. More information concerning accounting

for financial instruments can be found in Note 2,

Summary of

Significant Accounting Policies.

Types of Derivative Instruments

Interest Rate and Cross Currency Swaps

The corporation utilizes

interest rate swap derivatives to manage interest rate risk, in order

to maintain a targeted amount of both fixed-rate and floating-rate

long term debt and notes payable. Interest rate swap agreements

that are effective at hedging the fair value of fixed-rate debt agree-

ments are designated and accounted for as fair value hedges. In

2011, the corporation settled $285 million of interest rate swaps,

including a $50 million forward starting swap. The corporation has

a fixed interest rate on approximately 68% of long-term debt and

notes payable issued.

The corporation has issued certain foreign-denominated debt

instruments and utilizes cross currency swaps to reduce the vari-

ability of functional currency cash flows related to the foreign

currency debt. Cross currency swap agreements that are effective

at hedging the variability of foreign-denominated cash flows are

designated and accounted for as cash flow hedges.