Sara Lee 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62/63 Sara Lee Corporation and Subsidiaries

2011 versus 2010

Net sales decreased by $59 million, or 7.5%.

The change in sales was impacted by changes in foreign currency

exchange rates and the 53rd week in the prior year. The impact of

foreign currency changes, particularly the Australian dollar, increased

reported net sales by $3 million. Adjusted net sales decreased

$49 million, or 6.4% due to the negative impact of price reductions

in response to competitive pressures, which decreased net sales by

3.7% and lower unit volumes. Unit volumes decreased 2.5% due to

a decline in fresh bread volumes in Spain, as a result of a reduction

in branded sales due in part to economic and competitive pressures

and volume declines in Australia. These volume declines were par-

tially offset by increased refrigerated dough volumes in Europe.

Operating segment income increased by $2 million, or 10.9%.

The net change in foreign currency exchange rates, business restruc-

turing costs, Project Accelerate charges, impairment charges and

the 53rd week increased operating segment income by $31 million.

Adjusted operating segment income decreased by $29 million, or

65.0% due to the negative impact of pricing actions, lower unit

volumes, higher commodity costs and an unfavorable sales mix

shift to lower margin products partially offset by continuous

improvement savings.

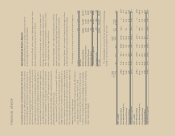

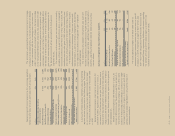

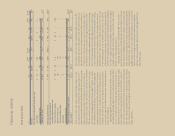

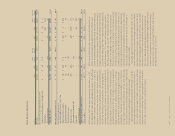

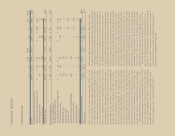

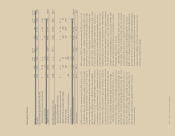

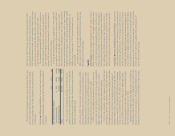

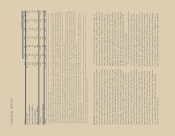

International Bakery

Dollar Percent Dollar Percent

In millions 2011 2010 Change Change 2010 2009 Change Change

Net sales $726 $785 $(59) (7.5) % $785 $«795 $«(10) (1.3) %

Less: increase/(decrease) in net sales from

Changes in foreign currency exchange rates $÷÷– $÷«(3) $÷«3 $÷÷– $÷(25) $÷25

Impact of 53rd week – 13 (13) 13 – 13

Adjusted net sales $726 $775 $(49) (6.4) % $772 $«820 $«(48) (5.8) %

Operating segment income (loss) $«(12) $«(14) $÷«2 10.9 % $«(14) $(194) $180 92.9 %

Less: Increase/(decrease) in

operating segment income (loss) from

Changes in foreign currency exchange rates $÷÷– $÷÷– $÷«– $÷÷– $÷÷(1) $÷÷1

Project Accelerate/transformation charges – (47) 47 (47) (38) (9)

Impairment charge – (13) 13 (13) (207) 194

International stranded overhead charges (28) – (28) – – –

Impact of 53rd week –1(1) 1–1

Adjusted operating segment income $««16 $««45 $(29) (65.0) % $««45 $÷«52 $«÷(7) (13.0) %

Gross margin % 35.0 % 38.6 % (3.6) % 38.6 % 37.5 % 1.1 %

2010 versus 2009

Net sales decreased by $10 million, or 1.3%.

The impact of changes in foreign currency exchange rates in the

European euro and Australian dollar increased reported net sales

by $25 million, while the impact of the 53rd week increased net

sales by $13 million. Adjusted net sales decreased by $48 million,

or 5.8%, as a result of the negative impact of price reductions in

response to lower commodity costs and competitive pressures,

which decreased net sales by approximately 4%. Sales were also

negatively impacted by lower unit volumes and an unfavorable sales

mix. Net unit volumes decreased 2.3% due to a decline in branded

fresh bread volumes in Spain due in part to the weak economic

conditions and competitive pressures. These volume declines were

partially offset by increased volumes in Australia and increased

refrigerated dough volumes in Europe.

Operating segment loss decreased by $180 million, or 92.9%.

The net change in foreign currency exchange rates, exit activities,

asset and business dispositions, impact of the 53rd week and

impairment charges increased operating segment income by

$187 million. Adjusted operating segment income decreased by

$7 million, or 13.0%, due to the negative impact of pricing actions,

lower unit volumes, and an unfavorable sales mix shift to lower

margin products partially offset by lower commodity costs and

continuous improvement savings.