Sara Lee 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70/71 Sara Lee Corporation and Subsidiaries

Commodities

The corporation is a purchaser of certain commodities

such as beef, pork, coffee, wheat, corn, corn syrup, soybean and

corn oils, butter, sugar, natural gas and diesel fuel. The corporation

generally buys these commodities based upon market prices that

are established with the vendor as part of the purchase process. In

circumstances where commodity derivative instruments are used,

there is a high correlation between the commodity costs and the

derivative instrument.

Risk Management Activities The corporation maintains risk

management control systems to monitor the foreign exchange,

interest rate and commodity risks, and the corporation’s offsetting

hedge positions. The risk management control system uses ana-

lytical techniques including market value, sensitivity analysis and

value at risk estimations.

Value at Risk

The value at risk estimations are intended to measure

the maximum amount the corporation could lose from adverse market

movements in interest rates and foreign currency exchange rates,

given a specified confidence level, over a given period of time. Loss

is defined in the value at risk estimation as fair market value loss.

As a result, foreign exchange gains or losses that are charged directly

to translation adjustments in common stockholders’ equity are

included in this estimate. The value at risk estimation utilizes histori-

cal interest rates and foreign currency exchange rates from the past

year to estimate the volatility and correlation of these rates in the

future. The model uses the variance-covariance statistical modeling

technique and includes all interest rate-sensitive debt and swaps,

foreign exchange hedges and their corresponding underlying expo-

sures. Foreign exchange value at risk includes the net assets

invested in foreign locations. The estimated value at risk amounts

shown below represent the potential loss the corporation could incur

from adverse changes in either interest rates or foreign currency

exchange rates for a one-day period. The average value at risk

amount represents the simple average of the quarterly amounts for

the past year. These amounts are not significant compared with the

equity, historical earnings trend or daily change in market capitaliza-

tion of the corporation.

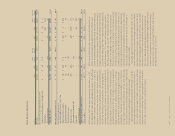

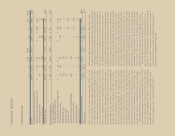

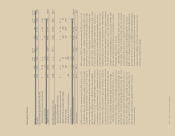

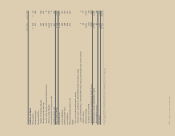

Time Confidence

In millions Amounts Average Interval Level

Value at risk amounts

2011

Interest rates $21 $24 1 day 95%

Foreign exchange 15 18 1 day 95%

2010

Interest rates $11 $12 1 day 95%

Foreign exchange 21 23 1 day 95%

Risk Management

Geographic Risks The corporation maintains a presence in a large

number of nations in the world. This includes geographic locations

where the corporation has a direct economic presence through

owned manufacturing or distribution facilities, or companies where

Sara Lee maintains a direct equity investment. The corporation also

has an indirect economic presence in many geographic locations

through third-party suppliers who provide inventory, distribution

services or business process outsourcing services. In most cases,

alternative sources of supply are available for inventory products

that are manufactured or purchased from these foreign locations.

However, the general insurance coverage that is maintained by

the corporation does not cover losses resulting from acts of war

or terrorism. As a result, a loss of a significant direct or indirect

manufacturing or distribution location could impact the corpora-

tion’s operations, cash flows and liquidity.

Foreign Exchange, Interest and Commodity Risks The corporation

is exposed to market risk from changes in foreign currency exchange

rates, interest rates and commodity prices. To mitigate the risk from

interest rate, foreign currency exchange rate and commodity price

fluctuations, the corporation enters into various hedging transactions

that have been authorized pursuant to the corporation’s policies and

procedures. The corporation does not use financial instruments for

trading purposes and is not a party to any leveraged derivatives.

Foreign Exchange

The corporation primarily uses foreign currency

forward and option contracts to hedge its exposure to adverse

changes in foreign currency exchange rates. The corporation’s

exposure to foreign currency exchange rates exists primarily with

the European euro, British pound, Brazilian real, Danish krone,

Hungarian forint, Russian ruble and Australian dollar against the U.S.

dollar. Hedging is accomplished through the use of financial instru-

ments as the gain or loss on the hedging instrument offsets the

gain or loss on an asset, a liability or a basis adjustment to a firm

commitment. Hedging of anticipated transactions is accomplished

with financial instruments as the realized gain or loss on the hedge

occurs on or near the maturity date of the anticipated transactions.

Interest Rates

The corporation uses interest rate swaps to modify

its exposure to interest rate movements, reduce borrowing costs

and to lock in interest rates on anticipated debt issuances. The

corporation’s net exposure to interest rate risk consists of floating-

rate instruments that are benchmarked to U.S. and European short-

term money market interest rates. Interest rate risk management

is accomplished through the use of swaps to modify interest

payments under these instruments.