Sara Lee 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

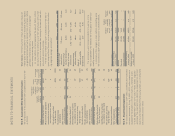

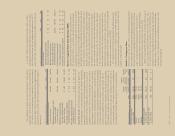

NOTES TO FINANCIAL STATEMENTS

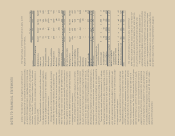

Information related to our cash flow hedges, net investment

hedges, fair value hedges and other derivatives not designated as

hedging instruments for the periods ended July 2, 2011, and July 3,

2010, follows:

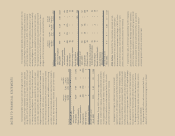

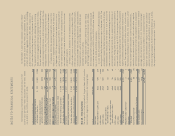

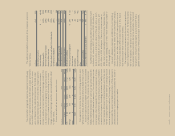

Information on the location and amounts of derivative fair values

in the Condensed Consolidated Balance Sheet at July 2, 2011 and

July 3, 2010 is as follows:

Assets Liabilities

Other Other Accrued

Current Assets Non-Current Assets Liabilities – Other Other

July 2, July 3, July 2, July 3, July 2, July 3, July 2, July 3,

In millions 2011 2010 2011 2010 2011 2010 2011 2010

Derivatives designated as hedging instruments

Interest rate contracts2$÷– $÷÷4 $12 $27 $÷÷2 $÷– $÷– $÷÷–

Foreign exchange contracts2– 143 – – 191 2 66 153

Commodity contracts1––––––––

Total derivatives designated as hedging instruments – 147 12 27 193 2 66 153

Derivatives not designated as hedging instruments

Foreign exchange contracts220 42 – – 13 42 – –

Commodity contracts12–––––––

Total derivatives not designated as hedging instruments 22 42 – – 13 42 – –

Total derivatives $22 $189 $12 $27 $206 $44 $66 $153

1 Categorized as level 1: Fair value of level 1 assets and liabilities as of July 2, 2011 are $2 million and nil and at July 3, 2010 are nil and nil, respectively.

2 Categorized as level 2: Fair value of level 2 assets and liabilities as of July 2, 2011 are $32 million and $272 million and at July 3, 2010 are $216 million and $197 million, respectively.

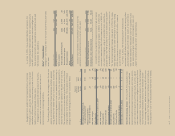

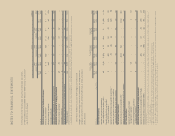

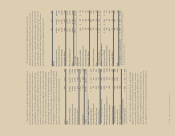

Interest Rate Foreign Exchange Commodity

Contracts Contracts Contracts Total

July 2, July 3, July 2, July 3, July 2, July 3, July 2, July 3,

In millions year ended 2011 2010 2011 2010 2011 2010 2011 2010

Cash Flow Derivatives

Amount of gain (loss) recognized in

other comprehensive income (OCI) 1$2 $«(4) $÷(69) $÷77 $14 $«– $÷(53) $÷73

Amount of gain (loss) reclassified

from AOCI into earnings 1, 2 3 – (82) 65 15 (4) (64) 61

Amount of ineffectiveness recognized in earnings3, 4 – – (9) (8) (1) – (10) (8)

Amount of gain (loss) expected to be classified

into earnings during the next twelve months –NA (7) NA –NA (7) NA

Net Investment Derivatives

Amount of gain (loss) recognized in OCI1– – (672) 411 – – (672) 411

Amount of gain (loss) recognized from OCI into earnings6––12–––12–

Fair Value Derivatives

Amount of derivative gain (loss)

recognized in earnings5319––––319

Amount of Hedged Item gain (loss)

recognized in earnings56(1)––––6(1)

Derivatives Not Designated as Hedging Instruments

Amount of gain (loss) recognized in Cost of Sales – – (46) 32 17 (5) (29) 27

Amount of gain (loss) recognized in SG&A – – 92 (60) 6 (1) 98 (61)

1 Effective portion.

2 Gain (loss) reclassified from AOCI into earnings is reported in interest, for interest rate swaps, in selling, general, and administrative (SG&A) expenses for foreign exchange contracts and in cost

of sales for commodity contracts.

3 Gain (loss) recognized in earnings is related to the ineffective portion and amounts excluded from the assessment of hedge effectiveness.

4 Gain (loss) recognized in earnings is reported in interest expense for foreign exchange contract and SG&A expenses for commodity contracts.

5 The amount of gain (loss) recognized in earnings on the derivative contracts and the related hedged item is reported in interest for the interest rate contracts and SG&A for the foreign exchange contracts.

6 The gain (loss) recognized from OCI into earnings is reported in gain on sale of discontinued operations.