Sara Lee 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL REVIEW

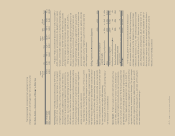

Consolidated Net Income and Diluted Earnings Per Share (EPS)

Net income was $1.296 billion in 2011, an increase of $769 mil-

lion over the prior year. The increase in net income was due to a

$1.0 billion increase in income from discontinued operations, which

was the result of a $361 million increase in income from discontin-

ued operations primarily related to a year-over-year reduction in the

tax provision related to the repatriation of foreign earnings and a

tax benefit related to the North American fresh bakery operations

and a $652 million increase in the gain on sale of businesses, which

related to the completion of the disposition of several household

and body care businesses in 2011. The increases in net income

were partially offset by the $244 million reduction in income from

continuing operations noted previously.

Net income was $527 million in 2010, an increase of $147 million

over the previous year. The increase in net income was due to a

$398 million increase in income from continuing operations as a

result of a reduction in after tax impairment charges on a year-over-

year basis partially offset by a $251 million reduction in net income

from discontinued operations due to the tax provision related to the

repatriation of foreign earnings.

The net income attributable to Sara Lee was $1.287 billion in

2011, $506 million in 2010 and $364 million in 2009.

Diluted EPS were $2.06 in 2011, $0.73 in 2010 and $0.52

in 2009. The diluted EPS in each succeeding year was favorably

impacted by lower average shares outstanding due to an ongoing

share repurchase program.

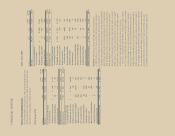

Operating Results by Business Segment

The corporation’s structure is currently organized around four

business segments, which are described below.

North American Retail

sells a variety of packaged meat and frozen

bakery products to retail customers in North America.

North American Foodservice

sells a variety of meat, bakery and

beverage products to foodservice customers in North America.

Sales are made in the foodservice channel to distributors, restau-

rants, hospitals and other large institutions.

International Beverage

sells coffee and tea products in certain

markets around the world, including Europe, Brazil and Australia.

Sales are made in both the retail and foodservice channels.

International Bakery

sells a variety of bakery and dough products

to retail and foodservice customers in Europe and Australia.

The following is a summary of results by business segment:

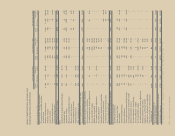

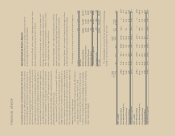

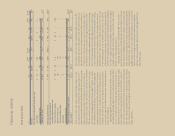

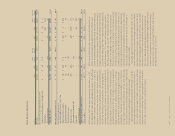

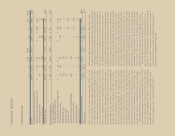

In millions 2011 2010 2009

Net sales

North American Retail $2,868 $2,818 $2,767

North American Foodservice 1,566 1,547 1,776

International Beverage 3,548 3,221 3,062

International Bakery 726 785 795

Total business segments 8,708 8,371 8,400

Intersegment sales (27) (32) (34)

Net sales $8,681 $8,339 $8,366

The following tables summarize the components of the percentage

change in net sales as compared to the prior year.

Volume Impact

(Excl. 53rd of 53rd Acq./ Foreign

Week) Mix Price Other Week Disp. Exchange Total

2011 vs 2010

North American Retail (3.8) % 1.8 % 5.5 % (0.2) % (1.9) % 0.4 % –% 1.8 %

North American Foodservice (13.4) 6.8 9.5 (0.1) (1.7) – 0.1 1.2

International Beverage (2.2) 2.0 6.0 4.1 (1.7) 1.1 0.9 10.2

International Bakery (2.5) (0.6) (3.7) 0.4 (1.5) – 0.4 (7.5)

Total business segments (4.7) % 2.5 % 5.6 % 1.5 % (1.7) % 0.5 % 0.4% 4.1 %

2010 vs 2009

North American Retail (5.5) % 6.8 % (1.5) % 0.1% 1.9 % – % –% 1.8 %

North American Foodservice (13.1) 6.3 0.1 0.1 1.5 (8.0) 0.2 (12.9)

International Beverage 1.4 (0.4) (0.7) (1.1) 1.6 0.4 4.0 5.2

International Bakery (2.3) (0.8) (3.6) 0.9 1.5 – 3.0 (1.3)

Total business segments (3.9) % 3.0 % (1.0) % (0.3) % 1.7 % (1.6) % 1.8% (0.3) %