Sara Lee 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Non-Indian Insecticides Business

In December 2010, the corporation

entered into an agreement to sell all of its non-Indian insecticides

businesses for €154 million and received a deposit of €152 million

($203 million – using foreign currency exchange rates on the date

of receipt) on the sale of this business. The deposit is recognized

as unrestricted cash, with an offsetting liability to the buyer, which

is reported in Accrued liabilities – Other in the Consolidated Balance

Sheet. However, as a result of competition concerns raised by the

European Commission, the parties abandoned the original sale

transaction in May 2011. Under the terms of the new sale agree-

ment, the original purchase price remains €154 million and the

corporation will complete the sale of various insecticides businesses

outside of the European Union (such as Malaysia, Singapore, Kenya

and Russia) to the original buyer. It will transfer the net proceeds

from the subsequent divestiture of the European portion of insecti-

cide businesses to the original buyer.

Business Sold in 2010

Godrej Sara Lee Joint Venture

In May 2010, the corporation

completed the disposition of its Godrej Sara Lee joint venture business,

which was part of the International Household and Body Care seg-

ment, and recognized an after tax gain on the disposition. A total

of $230 million of cash proceeds was received from the disposition

of this business.

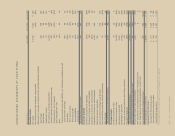

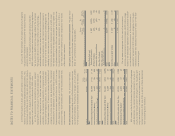

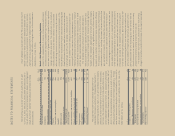

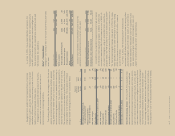

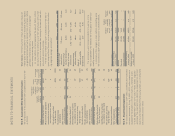

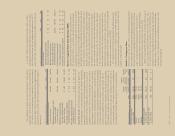

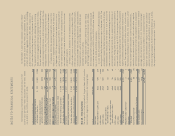

Discontinued Operations Cash Flows The corporation’s discontinued

operations impacted the cash flows of the corporation as summarized

in the table below.

In millions 2011 2010 2009

Discontinued operations impact on

Cash from operating activities $÷÷221 $«498 $«579

Cash from (used in) investing activities 2,446 119 (105)

Cash used in financing activities (2,667) (625) (468)

Net cash impact of

discontinued operations $÷÷÷««– $÷÷(8) $÷÷«6

Cash balance of discontinued operations

At start of period – $÷÷«8 $÷÷«2

At end of period ––8

Increase (decrease) in cash

of discontinued operations $÷÷÷««– $÷÷(8) $÷÷«6

The cash used in financing activities primarily represents the

net transfers of cash with the corporate office. The net assets of

the discontinued operations includes only the cash noted above

as most of the cash of those businesses has been retained as a

corporate asset.

Businesses Sold in 2011

Global Body Care and European Detergents

In December 2010,

the corporation completed the disposition of its global body care

and European detergents business. Using foreign currency exchange

rates on the date of the transaction, the corporation received cash

proceeds of $1.6 billion and reported an after tax gain on disposi-

tion of $491 million. The corporation entered into a customary

transitional services agreement with the purchaser of this business

to provide for the orderly separation of the business and the orderly

transition of various functions and processes which was completed

by the end of 2011.

Air Care Products Business

A majority of the air care products

business was sold in July 2010. Using foreign currency exchange

rates on the date of the transaction, the corporation has received

cash proceeds of $411 million to date, which represents the major-

ity of the proceeds to be received, and reported an after tax gain

on disposition of $94 million. When this business was sold, certain

operations were retained, primarily in Spain, until production related

to non-air care businesses ceases at the facility. Sara Lee will con-

tinue to manufacture air care products for the buyer for a period of

approximately five months after 2011, at which point the production

facility will be sold to the buyer and the final gain on the sale will

be recognized. The corporation entered into a customary transition

services agreement with the purchaser of this business to provide

for the orderly separation of the business and the orderly transition

of various functions and processes which completed by the end of

the second quarter of 2011.

Australia/New Zealand Bleach

In February 2011, the corporation

completed the sale of its Australia/New Zealand bleach business.

Using foreign currency exchange rates on the date of the transac-

tion, the corporation received cash proceeds of $53 million and

reported an after tax gain on disposition of $31 million.

Shoe Care Business

In May 2011, the corporation completed the

sale of the majority of its shoe care businesses. Using foreign cur-

rency exchange rates on the date of the transaction, the corporation

received cash proceeds of $276 million and reported an after tax

gain on disposition of $119 million. The corporation anticipates

receiving approximately $70 to $80 million more in future proceeds

on delayed sales and working capital adjustments from the buyer

in 2012.

92/93 Sara Lee Corporation and Subsidiaries