Sara Lee 2011 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 Sara Lee Corporation

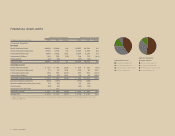

Unlocking shareholder value

March 2009 Announcement of strategic

review of Household and Body Care

February 2010 Announcement of $2.5 –

$3.0 billion share repurchase program

July 2010 Air Care sale closes

November 2010 Agreement to sell

North American Fresh Bakery; Acquisition

of Café Damasco in Brazil

December 2010 Body Care sale closes

January 2011 Announcement of

spin-off into two pure play companies

and intent to declare a $3.00 per share

special dividend

April 2011 Shoe Care sale closes

May 2011 Acquisition of Aidells

Sausage Company and announcement of

strategic review of International Bakery

and North American Refrigerated Dough

August 2011 Agreement to sell

North American Refrigerated Dough

THE PURE PLAY STRATEGY

Sara Lee has been on a journey, making

changes to the composition of our portfolio.

Each step is focused on creating and unlock-

ing shareholder value and streamlining our

operations. The spin-off of our International

Coffee & Tea business, creating two inde-

pendent entities, is the next logical step for

our shareholders, customers, consumers

and employees.

Benefits of pure play companies The term

“pure play” is frequently used to describe an

entity that focuses on one line of business

and whose products are closely related. This

single focus provides various benefits that

often translate into greater shareholder value.

Pure play companies offer the opportunity

to streamline operating structures and

reduce layers. This provides management

closer access to their end markets, which

improves decision making and can ultimately

lead to superior business performance.

Streamlined operations also provide cost

advantages. Pure plays can be unburdened

by the bureaucratic processes that weigh

down large entities and can bloat cost struc-

tures. Improved speed to market is another

advantage, as pure play companies are often

able to rapidly introduce new products and

more quickly react to changes in the market-

place. Due to their focus, pure plays often

find more opportunities for strategic partner-

ships or acquisitions that are not possible for

larger conglomerates. Additionally, pure play

companies are often preferable investment

vehicles because they more easily allow indi-

vidual investors to diversify their portfolio

according to their own preferences. The

combination of these benefits often drives

superior performance for pure play entities.

At Sara Lee, our most important

commitment is to maximize value for our

shareholders. The minimal overlap between

our two remaining businesses, coupled with

the benefits of the pure play structure, were

the key factors that drove the decision to

create two independent, pure play companies

for our shareholders.