Sara Lee 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL REVIEW

2011 versus 2010

Net sales increased by $327 million, or 10.2%.

The impact of foreign currency changes, particularly in the European

euro and Brazilian real, increased reported net sales by $27 million,

while acquisitions increased net sales by $33 million. The change

in net sales was negatively impacted by the additional 53rd week in

the prior year. Adjusted net sales increased by $315 million, or 9.9%

due to pricing actions, which included increased trade promotion

activity, higher green coffee export sales and an improved sales mix

partially offset by lower unit volumes. Pricing actions increased net

sales by 6.0%. Unit volumes decreased 2.2% due to unit volume

declines in the retail channel. Retail volumes in Europe decreased

due to volume declines in traditional roast and ground due in part to

the impact of multiple price increases to recover higher commodity

costs as well as competitive pressures from private label and hard

discounters and weak economic conditions throughout Europe, which

was partially offset by increases in single serve coffee volumes in

France and an increase in instants. The volume declines in Europe

were partially offset by improved volumes in the Asian region. Unit

volumes in the foodservice channel remained virtually unchanged.

Operating segment income decreased $140 million, or 23.6%.

Adjusted operating segment income decreased $104 million, or 17.5%

due to the negative impact of higher commodity costs, $55 million

of foreign currency hedging losses related to raw material purchases

and higher MAP spending, which were only partially offset by the

impact of pricing actions and a favorable shift in sales mix.

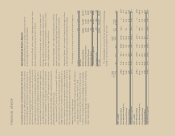

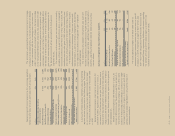

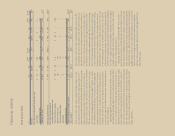

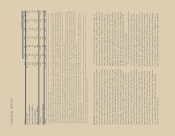

International Beverage

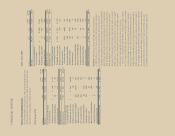

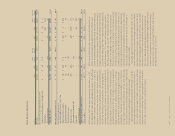

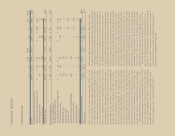

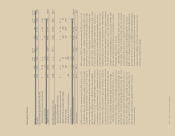

Dollar Percent Dollar Percent

In millions 2011 2010 Change Change 2010 2009 Change Change

Net sales $3,548 $3,221 $«327 10.2 % $3,221 $3,062 $159 5.2 %

Less: Increase/(decrease) in net sales from

Changes in foreign currency exchange rates $÷÷÷«– $÷÷(27) $÷«27 $÷÷÷«– $÷(124) $124

Acquisitions/dispositions 34 1 33 12 1 11

Impact of 53rd week – 48 (48) 48 – 48

Adjusted net sales $3,514 $3,199 $«315 9.9 % $3,161 $3,185 $«(24) (0.8) %

Operating segment income $÷«452 $÷«592 $(140) (23.6) % $÷«592 $÷«493 $««99 20.0 %

Less: Increase/(decrease) in

operating segment income from

Changes in foreign currency exchange rates $÷÷÷«– $÷÷««(6) $÷÷«6 $÷÷÷«– $÷÷(17) $÷17

Project Accelerate charges (1) (12) 11 (12) (53) 41

Spin-off related costs (1) – (1) – – –

Impairment charges (6) – (6) – – –

Curtailment gain – – – – 12 (12)

International stranded overhead charges (32) – (32) – – –

Gain on property disposition – – – – 14 (14)

Acquisitions/dispositions 3–3 1–1

Impact of 53rd week – 17 (17) 17 – 17

Adjusted operating segment income $÷«489 $÷«593 $(104) (17.5) % $÷«586 $÷«537 $÷49 8.8 %

Gross margin % 36.7 % 42.7 % (6.0) % 42.8 % 40.1 % 2.7 %

2010 versus 2009

Net sales increased by $159 million, or 5.2%.

The impact of changes in foreign currency exchange rates, particularly

in the European euro and Brazilian real, increased reported net sales

by $124 million, while the 53rd week increased net sales by $48 mil-

lion. Acquisitions net of dispositions, increased net sales by $11 mil-

lion. Adjusted net sales decreased by $24 million, or 0.8%, due to

lower green coffee export sales, increased trade promotions and an

unfavorable shift in sales mix, partially offset by an increase in unit

volumes. Pricing actions, which included increased trade promotion

activity, reduced net sales by approximately 1%. Unit volumes increased

1.4% due to volume growth in single serve coffee, traditional roast

and ground and instants, while overall coffee concentrate volumes

were virtually unchanged. Retail volumes in Europe decreased due to

volume declines in traditional roast and ground coffee due in part to

competitive pressures from private label and hard discounters as well

as weak economic conditions throughout Europe, which was partially

offset by increases in single serve coffee volumes primarily in France

and Germany. The volume declines in Europe were offset by improved

volumes in Brazil. Unit volumes in the foodservice channel in Europe

decreased due to continued weak economic conditions in Europe.

Operating segment income increased by $99 million, or 20.0%.

Adjusted operating segment income increased by $49 million, or

8.8%, due to lower commodity costs including the impact of hedging

gains, the increase in unit volumes, and the benefits of continuous

improvement programs, partially offset by the negative impact of

pricing actions and higher MAP spending.