Sara Lee 2011 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2011 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO FINANCIAL STATEMENTS

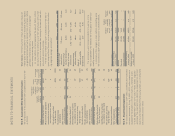

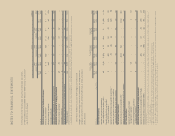

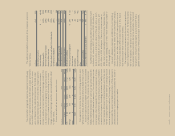

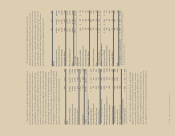

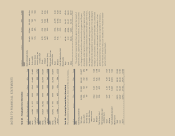

The funded status of defined benefit pension plans at the

respective year-ends was as follows:

U.S. Plans International Plans

In millions 2011 2010 2011 2010

Projected benefit obligation

Beginning of year $1,372 $1,172 $2,963 $2,689

Service cost 7173537

Interest cost 73 74 161 166

Plan amendments/other 8 – (24) –

Benefits paid (63) (63) (151) (143)

Participant contributions ––23

Actuarial (gain) loss (27) 207 (169) 500

Divestitures – – (8) –

Settlement/curtailment – (35) (6) (10)

Foreign exchange – – 310 (279)

End of year $1,370 $1,372 $3,113 $2,963

Fair value of plan assets

Beginning of year $1,127 $÷«857 $2,760 $2,652

Actual return on plan assets 179 177 241 397

Employer contributions 6 156 118 117

Participant contributions ––23

Benefits paid (63) (63) (151) (143)

Divestitures – – (5) –

Settlement –––(3)

Foreign exchange – – 307 (263)

End of year 1,249 1,127 3,272 2,760

Funded status $÷(121) $÷(245) $÷«159 $÷(203)

Amounts recognized on the

consolidated balance sheets

Noncurrent asset $÷÷÷«7 $÷÷÷«– $÷«258 $÷÷÷«7

Accrued liabilities (6) (5) (3) (1)

Pension obligation (122) (240) (96) (209)

Net asset (liability) recognized $««(121) $÷(245) $÷«159 $÷(203)

Amounts recognized in

accumulated other

comprehensive income

Unamortized prior service cost $÷÷÷«7 $÷÷÷«4 $÷÷«20 $÷÷«45

Unamortized actuarial loss, net 215 353 500 679

Total $÷«222 $÷«357 $÷«520 $÷«724

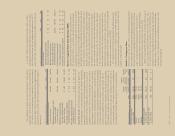

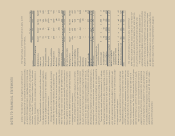

The underfunded status of the U.S. plans declined from

$245 million in 2010 to $121 million in 2011, due to a $122 mil-

lion increase in plan assets. The increase in plan assets was the

result of the strong investment performance during the year.

The funded status of the international plans improved to an

overfunded position of $159 million from a $203 million underfunded

position in the prior year. The improvement was the result of actuar-

ial gains, a strong investment performance and currency changes

as a $512 million increase in plan assets was only partially offset

by a $150 million increase in the projected benefit obligation.

In 2010, the corporation also recognized a curtailment loss of

$10 million associated with its household and body care businesses

as a result of the expected decline in expected years of future service.

This amount is being reported as part of the results of discontinued

operations. See Note 5 – “Discontinued Operations” for additional

information. The corporation also recognized a settlement loss of

$2 million in 2009.

The net periodic benefit cost associated with the North American

fresh bakery operations are recognized in discontinued operations

as the buyer is expected to assume all of the pension liabilities

associated with those businesses.

Although the results of the household and body care businesses

are classified as discontinued operations, the corporation has

retained a significant portion of the pension and postretirement

medical obligations related to these businesses. However, the corpo-

ration will no longer incur service cost for the participants in these

plans after these businesses are sold and this cost component is

being recognized in discontinued operations, while the remainder

of the net periodic benefit cost associated with these businesses

is recognized in continuing operations.

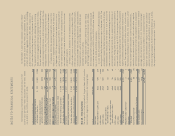

The net periodic benefit cost of the corporation’s U.S. defined

benefit pension plans in 2011 was $44 million lower than in 2010.

The decrease was primarily due to an increase in expected return

on assets due to an increase in plan assets resulting from improved

assets returns as well as a $200 million contribution into the U.S.

plans in the fourth quarter of 2010. The benefit costs were also favor-

ably impacted by a reduction in service cost and amortization due to

the freezing of the U.S salaried pension plan, which not only reduced

the amount of actuarial loss to be amortized but also increased the

period of time over which the amount is to being amortized.

The net periodic benefit cost of the corporation’s U. S. defined

benefit pension plans in 2010 was $34 million higher than in 2009.

The increase was primarily due to a $34 million increase in amorti-

zation of net actuarial losses due to net actuarial losses in the prior

year, which increased the amount subject to amortization; as well

as the increase in interest expense due to the year-over-year change

in projected benefit obligations.

The net periodic benefit cost of the corporation’s international

defined benefit pension plans in 2011 was $19 million lower than

in 2010 due to a $22 million improvement in the expected return on

assets partially offset by an increase in the amortization of actuarial

losses resulting from actuarial losses in the prior year due to a

decline in the discount rate. The 2010 expense was $6 million higher

than the 2009 due to a decline in the expected return on assets.

The amount of prior service cost and net actuarial loss that is

expected to be amortized from accumulated other comprehensive

income and reported as a component of net periodic benefit cost

in continuing operations during 2012 is $1 million and $2 million,

respectively, for U.S. plans and $3 million and $9 million, respec-

tively, for international plans.